425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on November 8, 2023

Filed by Cadeler A/S

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14d-2 of the Securities Exchange Act of 1934, as amended

Subject Company: Eneti Inc. (Commission File No.: 001-36231)

Registration Statement File No.: 333-275092

Investor presentation 8 November 2023

Important information (1/2) Important Additional Information Will be Filed with the SEC Cadeler A/S (“Cadeler”) commenced an offer to exchange all of the issued and outstanding shares of Eneti Inc. (“ Eneti ”) for shares or American Depositary Shares (“ADSs”) representing shares in Cadeler on 7 November 2023. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell s har es, nor is it a substitute for any offer materials that Cadeler or Eneti have filed or will file with the U.S. Securities and Exchange Commission (the “SEC”). Cadeler has filed with the SEC (1) a Tender Offer Statement on Schedule TO (2) a Registratio n S tatement on Form F - 4 that includes an offering prospectus with respect to the exchange offer, and (3) a Registration Statement on Form F - 6, and Eneti has filed with the SEC a Solicitation/Recommendation Statement on Schedule 14D - 9, in each case with respect to the exchange off er. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT/PROSPECTUS, THE EXCHANGE OFFER MATERIALS (INCLUDING THE OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMI TTA L AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, IF AND WHEN THEY BECOME AVAILABLE, AND ANY OTHER DOCUMENTS FILED BY EACH OF CADELER AN D E NETI WITH THE SEC, OR APPROVED BY THE DANISH FSA, IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION (INCLUDING THE EXCHANGE OFFER) OR INCORPORATED BY REFERENCE THEREIN CAREFULLY AND IN THEIR ENT IRETY AS THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT CADELER, ENETI, THE PROPOSED TRANSACTION AND RELATED MATTERS THAT HOLDERS OF THE COMPANY’S SECURITIES SHOULD CONSIDER BEFORE MAK ING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. Investors and stockholders will be able to obtain the registration statement/prospectus, the exchange offer materials (including the offer to exchange, a related letter of transmittal and certain other exchange offer documents), the solicitation/recommendation statement, and other documents filed with the SEC by Cadeler and Eneti at no cost to them through the website maintained by the SEC at www.sec.gov . In addition, investors and stockholders may obtain copies of any document filed with the SEC by Cadeler free of charge from Cadeler’s website at www.cadeler.com , and copies of any document filed with the SEC by Eneti free of charge from Eneti’s website at www.eneti - inc.com . The contents of this communication should not be construed as financial, legal, business, investment, tax or other professional advice. Each recip ien t should consult with its own professional advisors for any such matter and advice. This communication and the prospectus referred to above does not constitute a prospectus as defined by Regulation (EU) No. 20 17/ 1129 of 14 June 2017 (the “EU/EEA Prospectus Regulation”) and no public takeover offer is made pursuant to the Directive 2004/25/EC of 21 April 2004 on takeover bids in connection with the exchange offer referred to above. A pros pec tus pursuant to the EU/EEA Prospectus Regulation is expected to be published by Cadeler following completion of the offer period under the exchange offer referred to above for the purpose of admission to trading of the new Cad eler Shares underlying the Cadeler ADSs to the Oslo Stock Exchange. This communication does not contain all the information that should be considered concerning the Offer and is not intended to form the basis of any investment de cis ion or any other decision in respect of the proposed transaction. No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe f or, exchange or buy or an invitation to purchase, exchange or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of s ecu rities in any jurisdiction, in each case in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act and applicable European or UK, as appro pri ate, regulations. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would const itu te a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction. This communication is addressed to and directed only at, persons who are outside the United Kingdom or, in the United Kingdom , a t authorised or exempt persons within the meaning of the Financial Services and Markets Act 2000 or persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services an d M arkets Act 2000 (Financial Promotion) Order 2005 (the “Order”), persons falling within Article 49(2)(a) to (d) of the Order or persons to whom it may otherwise lawfully be communicated pursuant to the Order, (all such persons together being re fer red to as, “Relevant Persons”). This presentation is directed only at Relevant Persons. Other persons should not act or rely on this presentation or any of its contents. Any investment or investment activity to which this presentation re lates is available only to Relevant Persons and will be engaged in only with such persons. Solicitations resulting from this presentation will only be responded to if the person concerned is a Relevant Person. Market Data Information provided herein as it relates to the market environment in which each of Cadeler and Eneti operate or any market developments or trends is based on data and reports prepared by third parties and/or Cadeler or Eneti based on internal information and information derived from such third - party sources. Third party industry publications, studies and surve ys generally state that the data contained therein have been obtained from sources believed to be reliable, but that there is no guarantee of the accuracy or completeness of such data.

Important information (2/2) Forward - Looking Statements This communication includes forward - looking statements within the meaning of the federal securities laws (including Section 27A of the United States Securities Act of 1933, as amended, the “Securities Act”) with respect to the proposed transaction between Eneti and Cadeler , including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the products and se rvices offered by Eneti and Cadeler and the markets in which they operate, and Eneti’s and Cadeler’s projected future financial and operating results. These forward - looking statements are generally identified by terminology such as “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “should,” “project,” “target,” “plan,” “expect,” or the negatives of these terms or variations of th em or similar terminology. The absence of these words, however, does not mean that the statements are not forward - looking. These forward - looking statements are based upon current expectations, beliefs, estimates and assumptions that, while considered reasonable as and when made by Eneti and its management, and Cadeler and its management, as the case may be. Such forward - looking statements are subject to risks, uncertainties, and other factors that coul d cause actual results to differ materially from those expressed or implied by such forward - looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Neit her Eneti nor Cadeler undertake any obligation to update any such statements in light of any future event or circumstance, or to conform such statements to actual results. Past performance should not be relied upon, and is not, a guar ant ee of future performance. Many factors could cause actual future events to differ materially from the forward - looking statements in this presentation, inc luding but not limited to: the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Eneti’s and Cadeler’s securities, the failure to satisfy the conditions to the consummation of the transaction, including the acceptance of the pro po sed exchange offer by the requisite number of Eneti shareholders and the receipt of certain governmental and regulatory approvals, general domestic and international political c ond itions or hostilities, including the war between Russia and Ukraine; the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, the effects of public healt h t hreats, pandemics and epidemics, and the adverse impact thereof on Eneti’s or Cadeler’s business, financial condition and results of operations, the effect of the announcement or pendency of the transaction on Eneti’s or Cadeler’s business relationships, performance, and business generally, risks that the proposed transaction disrupts current plans of Eneti or Cadeler and potential difficulties in Eneti’s or Cadeler’s employee retention as a result of the proposed transaction, the outcome of any legal proceedings that may be instituted again st Eneti or Cadeler related to the business combination agreement or the proposed transaction or as a result of the operation of their respective businesses, the risk th at Cadeler is unable to list the ADSs to be offered as consideration, or the underlying shares in Cadeler, on the New York Stock Exchange or the Oslo Stock Exchange, as applicable, volatility in the price of the combined company’s securities d ue to a variety of factors, including changes in the competitive markets in which the combined company plans to operate, variations in performance across competitors, changes in laws and regulations affecting such business and changes in th e combined capital structure, factors affecting the duration of contracts, the actual amount of downtime and the respective backlogs of Eneti and Cadeler, factors that reduce applicable dayrates or contract profitability, operating hazards inherent to offshore operations and delays, dependency on third parties in relat io n to, for example, technical, maintenance and other commercial services, risks associated with operations outside the US, actions by regulatory authorities , c redit rating agencies, customers, joint venture partners, contractors, lenders and other third parties, legislation and regulations affecting the combined company’s operations, compliance with regulatory requirements, violations of anti - corrupt ion laws, shipyard risk and timing, hurricanes and other weather conditions, and the future price of energy commodities, the ability to implement business plans, forecasts, and other expectations (including with respect to synergies and financial and operational metrics, such as EBITDA and free cash flow) after the completion of the proposed transaction, and to identify and realize additional opportunities, the failure to realize anticipated benefits of the propose d t ransaction, risks related to the ability to correctly estimate operating expenses and expenses associated with the business combination, risks related to the ability to project future cash utilization and reserves needed for contingent futu re liabilities and business operations, the potential impact of announcement or consummation of the proposed transaction on relationships with third parties, changes in law or regulations affecting Eneti , Cadeler or the combined company, international, national or local economic, social or political conditions that could adver sel y affect the companies and their business, dependency on Eneti and Cadeler’s customers, volatility in demand, increased competition or reduction in contract values, the risk that technological progress mi ght render the technologies used by each of Cadeler and Eneti obsolete, conditions in the credit markets that may negatively affect the companies and their business, risks deriving from t he restrictive covenants and conditions relevant to Eneti and Cadeler’s financing and their respective ability to obtain future financing, including for remaining installations on ordered newbuild vessels, risks associated with assumptions th at parties make in connection with the parties’ critical accounting estimates and other judgements, the risk that Eneti and Cadeler have a limited number of vessels and are vulnerable in the event of a loss of revenue relating to any such vessel (s ), risks relating to delays in, or increases in the cost of, already ordered newbuild vessels and the risk of a failure to obtain contracts for such newbuild vessels and risks associated with changes in exchange rates including the USD/N OK and USD/EUR rates. The foregoing list of factors is not exhaustive and the factors identified are not set out in any particular order. There can be no assurance that future developments affecting Eneti , Cadeler or the combined company will be those that the companies have anticipated. These forward - looking statements involve a number of risks, uncertainties (some of which are beyond Eneti’s or Cadeler’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements or from our historical experience and our present expectations or proje cts. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the parties’ businesses, including those described in Eneti’s Annual Report on Form 20 - F, Current Reports on Form 6 - K and other documents filed from time to time by Eneti with the SEC and those described in Cadeler’s annual reports, relevant reports and other documents published from time to time by Cadeler . Eneti and Cadeler wish to caution you not to place undue reliance on any forward - looking statements, which speak only as of the date hereof. Thi s communication and related materials speak only as of the date hereof and except as required by law, Eneti and Cadeler are not undertaking any obligation to update or revise any forward - looking statements whether as a result of new information, f uture events or otherwise.

Agenda 2) Combination overview 3) Company and financial update 1) Introduction to Cadeler 4) Market outlook

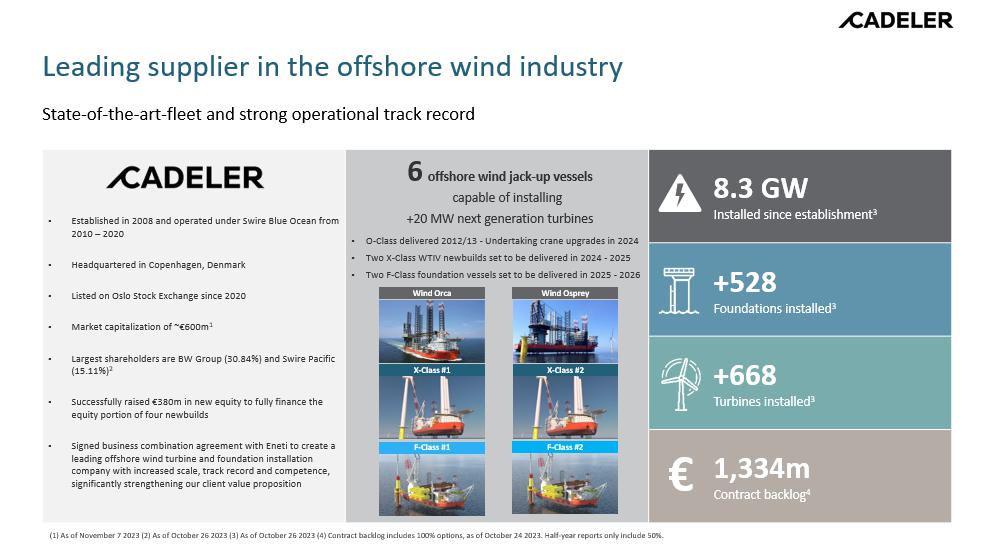

Leading supplier in the offshore wind industry State - of - the - art - fleet and strong operational track record • Established in 2008 and operated under Swire Blue Ocean from 2010 – 2020 • Headquartered in Copenhagen, Denmark • Listed on Oslo Stock Exchange since 2020 • Market capitalization of ~€600m 1 • Largest shareholders are BW Group (30.84%) and Swire Pacific (15.11%) 2 • Successfully raised €380m in new equity to fully finance the equity portion of four newbuilds • Signed business combination agreement with Eneti t o create a leading offshore wind turbine and foundation installation company with increased scale, track record and competence, significantly strengthening our client value proposition 6 offshore wind jack - up vessels capable of installing +20 MW next generation turbines • O - Class delivered 2012/13 - Undertaking crane upgrades in 2024 • Two X - Class WTIV newbuilds set to be delivered in 2024 - 2025 • Two F - Class foundation vessels set to be delivered in 2025 - 2026 8.3 GW Installed since establishment 3 +528 Foundations installed 3 +668 Turbines installed 3 1,334m Contract backlog 4 (1) As of November 7 2023 (2) As of October 26 2023 (3) As of October 26 2023 (4) Contract backlog includes 100% options, as of October 24 2023. Half - year reports only include 50%. Wind Orca Wind Osprey X - Class #2 F - Class #2 X - Class #1 F - Class #1 €

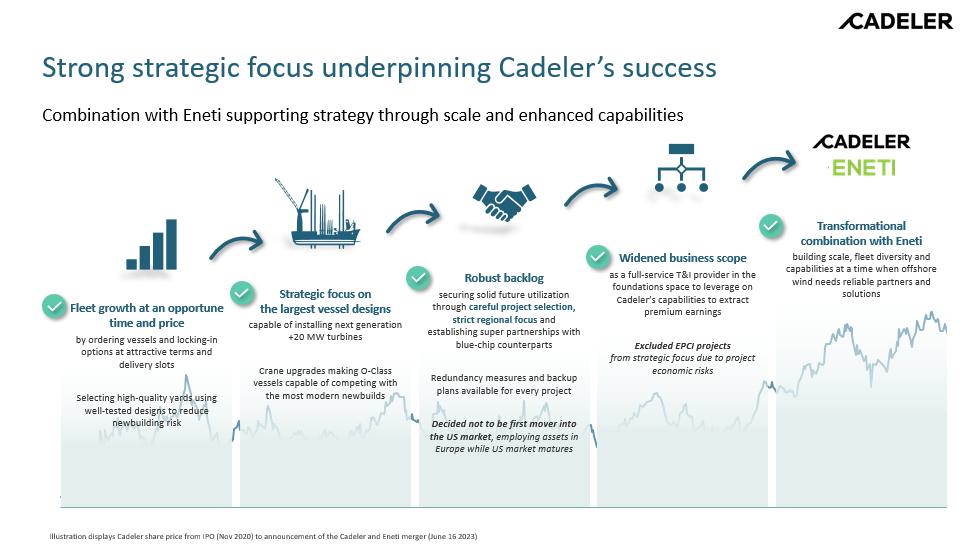

Widened business scope as a full - service T&I provider in the foundations space to leverage on Cadeler’s capabilities to extract premium earnings Excluded EPCI projects from strategic focus due to project economi c risks Transformational combination with Eneti building scale, fleet diversity and capabilities at a time when offshore wind needs reliable partners and solutions Illustration displays Cadeler share price from IPO (Nov 2020) to announcement of the Cadeler and Eneti merger (June 16 2023) Strong strategic focus underpinning Cadeler’s success Combination with Eneti supporting strategy through scale and enhanced capabilities Fleet growth at an opportune time and price by ordering vessels and locking - in options at attractive terms and delivery slots Selecting high - quality yards using well - tested designs to reduce newbuilding risk Strategic focus on the largest vessel designs capable of installing next generation +20 MW turbines Crane upgrades making O - Class vessels capable of competing with the most modern newbuilds Robust backlog s ecuring solid future utilization through careful project selection, strict regional focus and establishing super partnerships with blue - chip counterparts Redundancy measures and backup plans available for every project Decided not to be first mover into the US market , employing assets in Europe while US market matures

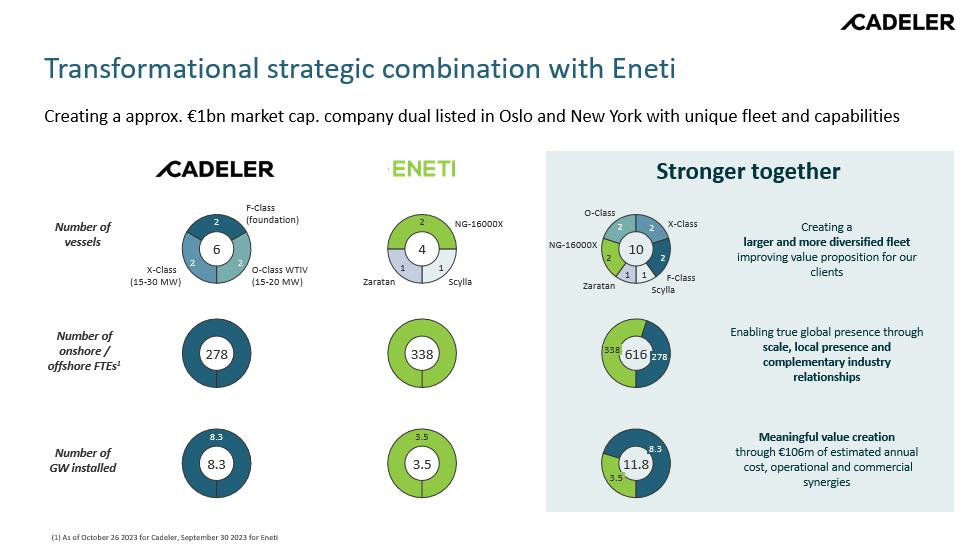

Stronger together Creating a larger and more diversified fleet improving value proposition for our clients Enabling true global presence through scale, local presence and complementary industry relationships Meaningful value creation through €106m of estimated annual cost, operational and commercial synergies Transformational strategic combination with Eneti Creating a approx. €1bn market cap. company dual listed in Oslo and New York with unique fleet and capabilities 2 O - Class WTIV (15 - 20 MW) 2 X - Class (15 - 30 MW) 2 F - Class (foundation) 1 Scylla 1 Zaratan 2 NG - 16000X 6 4 1 Scylla 1 Zaratan 2 NG - 16000X 2 O - Class 2 X - Class 2 F - Class 10 278 338 8.3 8.3 3.5 3.5 8.3 3.5 11.8 Number of vessels Number of onshore / offshore FTEs 1 Number of GW installed 278 616 338 (1) As of October 26 2023 for Cadeler, September 30 2023 for Eneti

Agenda 2) Combination overview 3) Company and financial update 1) Introduction to Cadeler 4) Market outlook

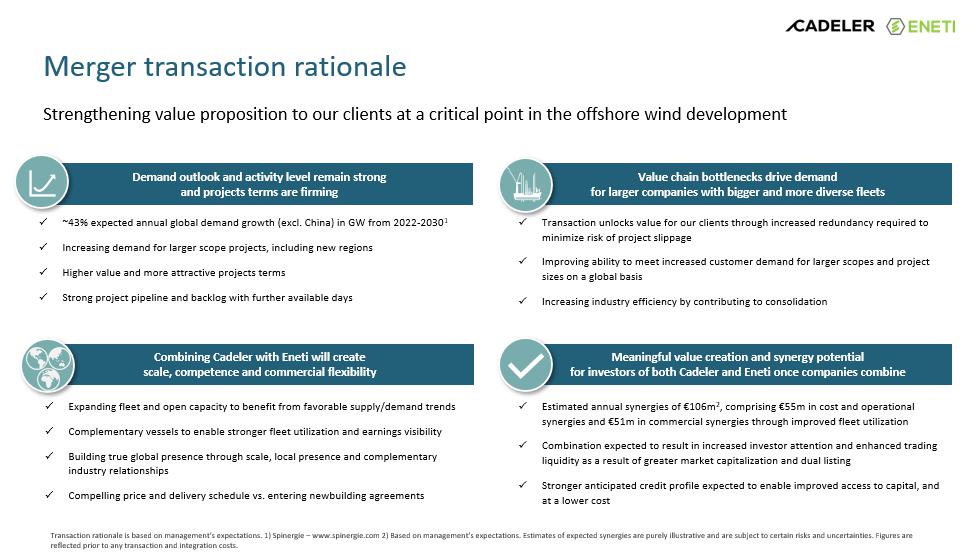

Transaction rationale is based on management’s expectations. 1) Spinergie – www.spinergie.com 2) Based on management’s expectations. Estimates of expected synergies are purely illustrative and are subj ect to certain risks and uncertainties. Figures are reflected prior to any transaction and integration costs. Merger transaction rationale Strengthening value proposition to our clients at a critical point in the offshore wind development Demand outlook and activity level remain strong and projects terms are firming x ~43% expected annual global demand growth (excl. China) in GW from 2022 - 2030 1 x Increasing demand for larger scope projects, including new regions x Higher value and more attractive projects terms x Strong project pipeline and backlog with further available days Value chain bottlenecks drive demand for larger companies with bigger and more diverse fleets x Transaction unlocks value for our clients through increased redundancy required to minimize risk of project slippage x Improving ability to meet increased customer demand for larger scopes and project sizes on a global basis x Increasing industry efficiency by contributing to consolidation Combining Cadeler with Eneti will create scale, competence and commercial flexibility x Expanding fleet and open capacity to benefit from favorable supply/demand trends x Complementary vessels to enable stronger fleet utilization and earnings visibility x Building true global presence through scale, local presence and complementary industry relationships x Compelling price and delivery schedule vs. entering newbuilding agreements Meaningful value creation and synergy potential for investors of both Cadeler and Eneti once companies combine x Estimated annual synergies of €106m 2 , comprising €55m in cost and operational synergies and €51m in commercial synergies through improved fleet utilization x Combination expected to result in increased investor attention and enhanced trading liquidity as a result of greater market capitalization and dual listing x Stronger anticipated credit profile expected to enable improved access to capital, and at a lower cost

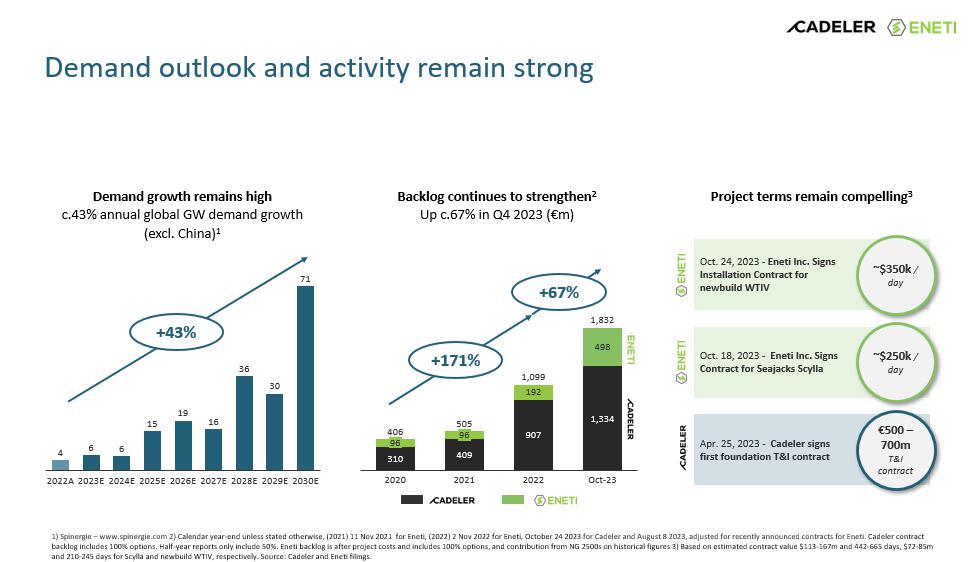

1) Spinergie – www.spinergie.com 2) Calendar year - end unless stated otherwise, (2021) 11 Nov 2021 for Eneti , (2022) 2 Nov 2022 for Eneti , October 24 2023 for Cadeler and August 8 2023, adjusted for recently announced contracts for Eneti . Cadeler contract backlog includes 100% options. Half - year reports only include 50%. Eneti backlog is after project costs and includes 100% options, and contribution from NG 2500s on historical figures 3) Based on estimated contract value $113 - 167m and 442 - 665 days, $72 - 85m and 210 - 245 days for Scylla and newbuild WTIV, respectively. Source: Cadeler and Eneti filings. Demand outlook and activity remain strong 1,392 Demand growth remains high c.43% annual global GW demand growth (excl. China) 1 Project terms remain compelling 3 Backlog continues to strengthen 2 Up c.67% in Q4 2023 (€m) + 171 % +67% 310 409 907 1,334 192 498 96 2020 96 2021 2022 Oct - 23 406 505 1,099 1,832 Oct. 24, 2023 - Eneti Inc. Signs Installation Contract for newbuild WTIV ~$350k / day Oct. 18, 2023 - Eneti Inc. Signs Contract for Seajacks Scylla ~$250k / day Apr. 25, 2023 - Cadeler signs first foundation T&I contract €500 – 700m T&I contract 2022A 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2030E 4 6 6 15 19 16 36 30 71 + 43 %

Source: Financial Times, Reuters, OffshoreWIND , Bloomberg, The Economist, reNEWS Value chain bottlenecks drive demand for larger companies Announced wind capacity has never been higher, yet the industry is facing significant headwinds

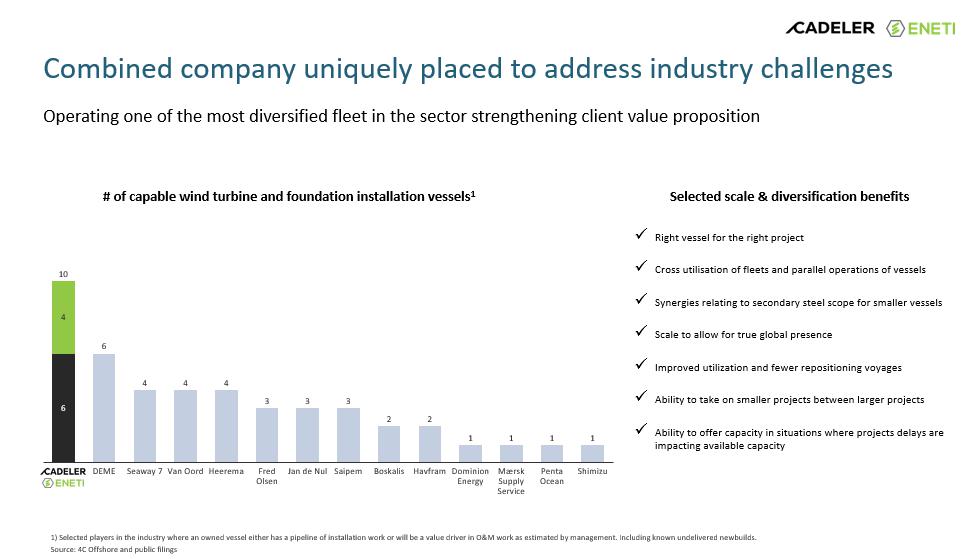

1) Selected players in the industry where an owned vessel either has a pipeline of installation work or will be a value drive r i n O&M work as estimated by management. Including known undelivered newbuilds. Source: 4C Offshore and public filings Combined company uniquely placed to address industry challenges Operating one of the most diversified fleet in the sector strengthening client value proposition # of capable wind turbine and foundation installation vessels 1 x Right vessel for the right project x Cross utilisation of fleets and parallel operations of vessels x Synergies relating to secondary steel scope for smaller vessels x Scale to allow for true global presence x Improved utilization and fewer repositioning voyages x Ability to take on smaller projects between larger projects x Ability to offer capacity in situations where projects delays are impacting available capacity Selected scale & diversification benefits 6 6 4 4 4 3 3 3 2 2 1 1 1 1 4 DEME Seaway 7 Van Oord Heerema Fred Olsen Jan de Nul Saipem Boskalis Havfram Dominion Energy Mærsk Supply Service Penta Ocean Shimizu 10

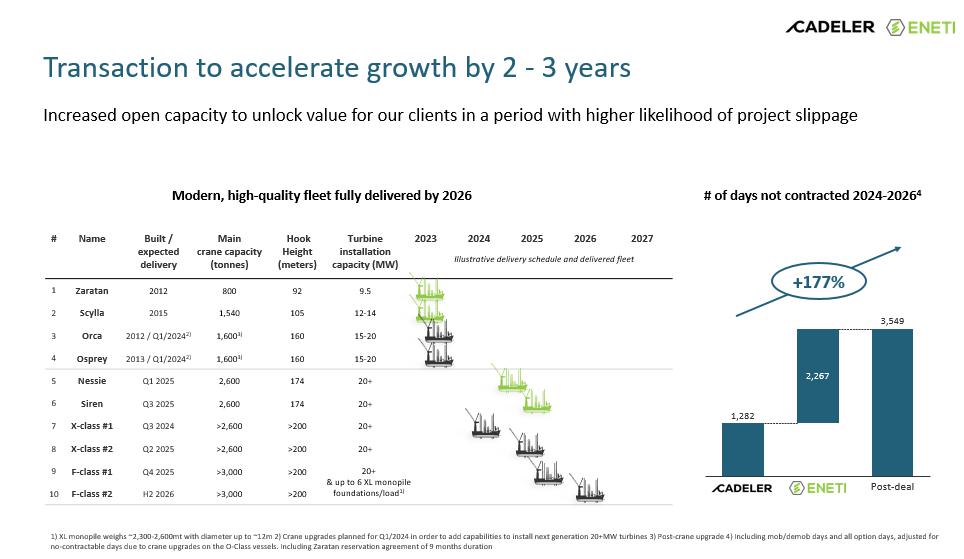

1) XL monopile weighs ~2,300 - 2,600mt with diameter up to ~12m 2) Crane upgrades planned for Q1/2024 in order to add capabilities to install next generation 20+MW turbines 3) Post - crane upgrade 4) Including mob/ demob days and all option days, adjusted for no - contractable days due to crane upgrades on the O - Class vessels. Including Zaratan reservation agreement of 9 months duration Transaction to accelerate growth by 2 - 3 years Increased open capacity to unlock value for our clients in a period with higher likelihood of project slippage # of days not contracted 2024 - 2026 4 +177% 1,282 3,549 2,267 Post - deal Modern, high - quality fleet fully delivered by 2026 # Name Built / expected delivery Main crane capacity ( tonnes ) Hook Height (meters) Turbine installation capacity (MW) 2023 2024 2025 2026 2027 1 Zaratan 2012 800 92 9.5 2 Scylla 2015 1,540 105 12 - 14 3 Orca 2012 / Q1/2024 2) 1,600 3) 160 15 - 20 4 Osprey 2013 / Q1/2024 2) 1,600 3) 160 15 - 20 5 Nessie Q1 2025 2,600 174 20+ 6 Siren Q3 2025 2,600 174 20+ 7 X - class #1 Q3 2024 >2,600 >200 20+ 8 X - class #2 Q2 2025 >2,600 >200 20+ 9 F - class #1 Q4 2025 >3,000 >200 10 F - class #2 H2 2026 >3,000 >200 20+ & up to 6 XL monopile foundations/load 1) Illustrative delivery schedule and delivered fleet

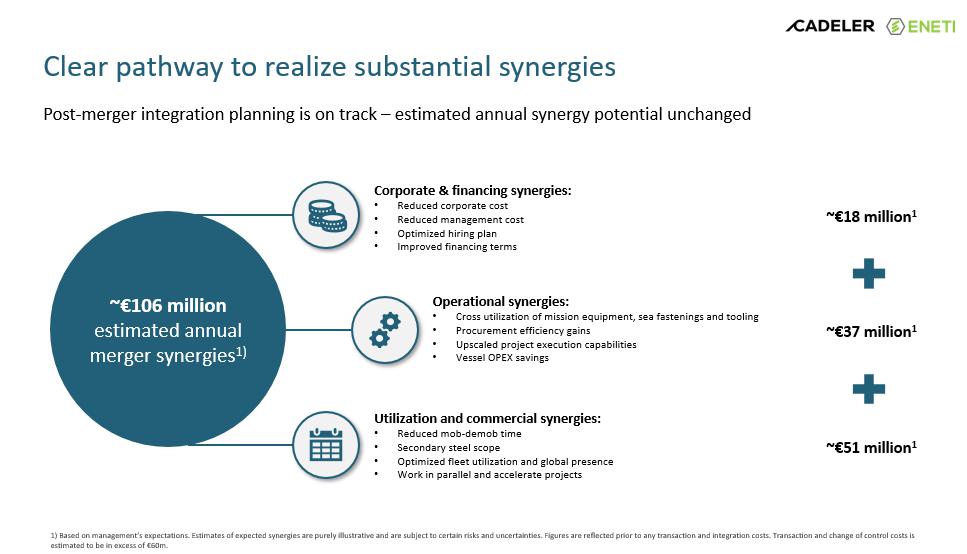

1) Based on management’s expectations. Estimates of expected synergies are purely illustrative and are subject to certain ris ks and uncertainties. Figures are reflected prior to any transaction and integration costs. Transaction and change of control co sts is estimated to be in excess of €60m. Clear pathway to realize substantial synergies Post - merger integration planning is on track – estimated annual synergy potential unchanged ~€106 million e stimated annual merger synergies 1) Corporate & financing synergies: • Reduced corporate cost • Reduced management cost • Optimized hiring plan • Improved financing terms Operational synergies: • Cross utilization of mission equipment, sea fastenings and tooling • Procurement efficiency gains • Upscaled project execution capabilities • Vessel OPEX savings Utilization and commercial synergies: • Reduced mob - demob time • Secondary steel scope • Optimized fleet utilization and global presence • Work in parallel and accelerate projects ~€18 million 1 ~€37 million 1 ~€51 million 1

Market dynamics between floaters and jack - ups Highly capable jack - up vessels can operate efficiently in both the foundation and WTG installation spaces. This opens up for highly attractive scopes and increases optionality in markets with expected tightness in supply • Stricter operational limits for floating vessels • Difficult ocean conditions causing installation delays • Significant delivery issues for motion compensated pile grippers • Foundation installation using jack - ups is an efficient, proven and resilient installation method • Newbuild jack - ups are capable of installing next generation MPs • Simpler mission equipment on jack - ups • Foundation T&I scope offers large, profitable contracts and an attractive alternative for jack - ups • Only capable jack - ups can efficiently switch and service all scopes Floating vessels have had issues efficiently installing monopiles and transition pieces (TPs) Jack - ups are highly capable and reliable at installing monopiles and TPs For highly capable jack - ups, foundation installation offers attractive terms and increased optionality This development further reduces supply in the already tight WTG installation and O&M space Operating one of the world’s largest fleet of highly capable jack - ups offers substantial value in offshore wind

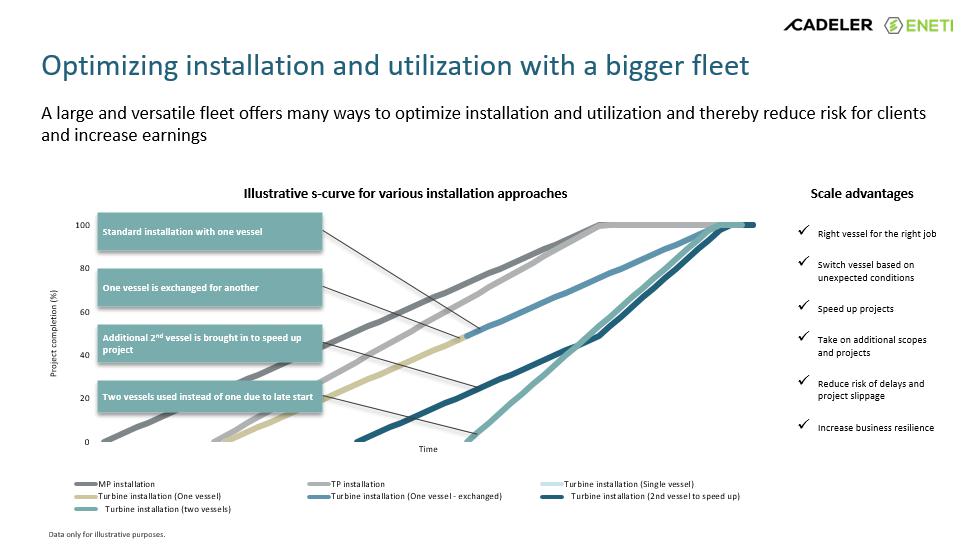

Data only for illustrative purposes. Optimizing installation and utilization with a bigger fleet A large and versatile fleet offers many ways to optimize installation and utilization and thereby reduce risk for clients and increase earnings 0 20 40 60 80 100 Project completion (%) Time MP installation TP installation Turbine installation (Single vessel) Turbine installation (One vessel) Turbine installation (One vessel - exchanged) - Turbine installation (2nd vessel to speed up) - Turbine installation (two vessels) Illustrative s - curve for various installation approaches Scale advantages x Right vessel for the right job x Switch vessel based on unexpected conditions x Speed up projects x Take on additional scopes and projects x Reduce risk of delays and project slippage x Increase business resilience One vessel is exchanged for another Additional 2 nd vessel is brought in to speed up project Two vessels used instead of one due to late start Standard installation with one vessel

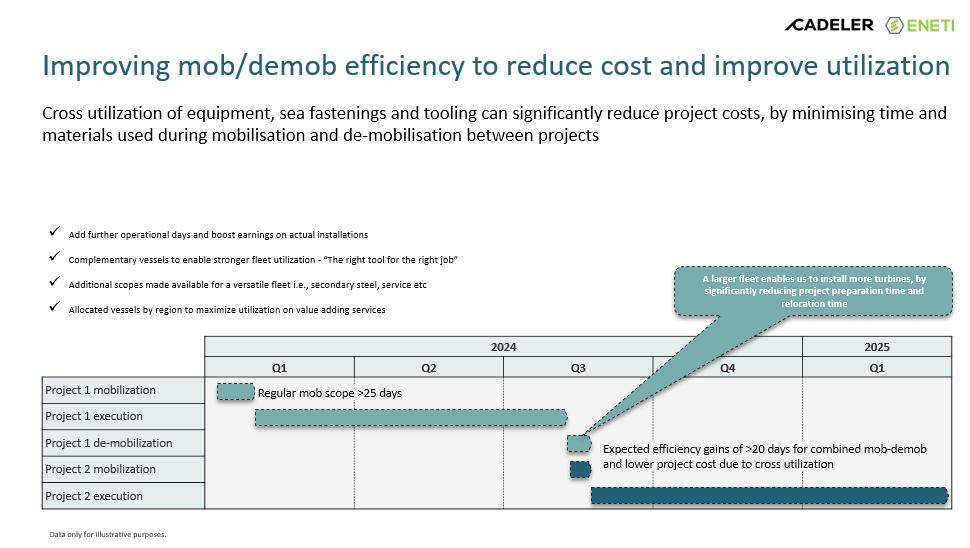

Data only for illustrative purposes. Improving mob/ demob efficiency to reduce cost and improve utilization Cross utilization of equipment, sea fastenings and tooling can significantly reduce project costs, by minimising time and materials used during mobilisation and de - mobilisation between projects 2024 2025 Q1 Q2 Q3 Q4 Q1 Project 1 mobilization Project 1 execution Project 1 de - mobilization Project 2 mobilization Project 2 execution Regular mob scope >25 days Expected efficiency gains of >20 days for combined mob - demob and lower project cost due to cross utilization A larger fleet enables us to install more turbines, by significantly reducing project preparation time and relocation time x Add further operational days and boost earnings on actual installations x Complementary vessels to enable stronger fleet utilization - “The right tool for the right job” x Additional scopes made available for a versatile fleet i.e., secondary steel, service etc x Allocated vessels by region to maximize utilization on value adding services

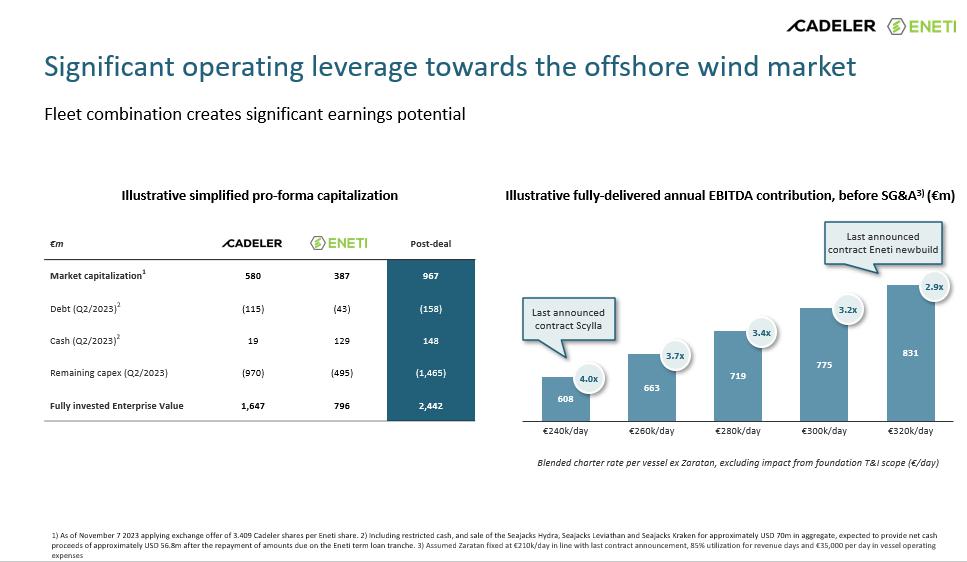

1) As of November 7 2023 applying exchange offer of 3.409 Cadeler shares per Eneti share. 2) Including restricted cash, and sale of the Seajacks Hydra, Seajacks Leviathan and Seajacks Kraken for approximately U SD 70m in aggregate, expected to provide net cash proceeds of approximately USD 56.8m after the repayment of amounts due on the Eneti term loan tranche . 3) Assumed Zaratan fixed at €210k/day in line with last contract announcement, 85% utilization for revenue days and €35,000 per day in vessel op er ating expenses Significant operating leverage towards the offshore wind market Fleet combination creates significant earnings potential €m Cadeler Eneti Post - deal Market capitalization 1 580 387 967 Debt (Q2/2023) 2 (115) (43) (158) Cash (Q2/2023) 2 19 129 148 Remaining capex (Q2/2023) (970) (495) (1,465) Fully invested Enterprise Value 1,647 796 2,442 Illustrative fully - delivered annual EBITDA contribution , before SG&A 3 ) (€m) 608 663 719 775 831 €240k/day €260k/day €280k/day €300k/day €320k/day Blended charter rate per vessel ex Zaratan , excluding impact from foundation T&I scope (€/day) Illustrative simplified pro - forma capitalization 4.0x 3.7x 3.4x 3.2x 2.9 x Last announced contract Scylla Last announced contract Eneti newbuild

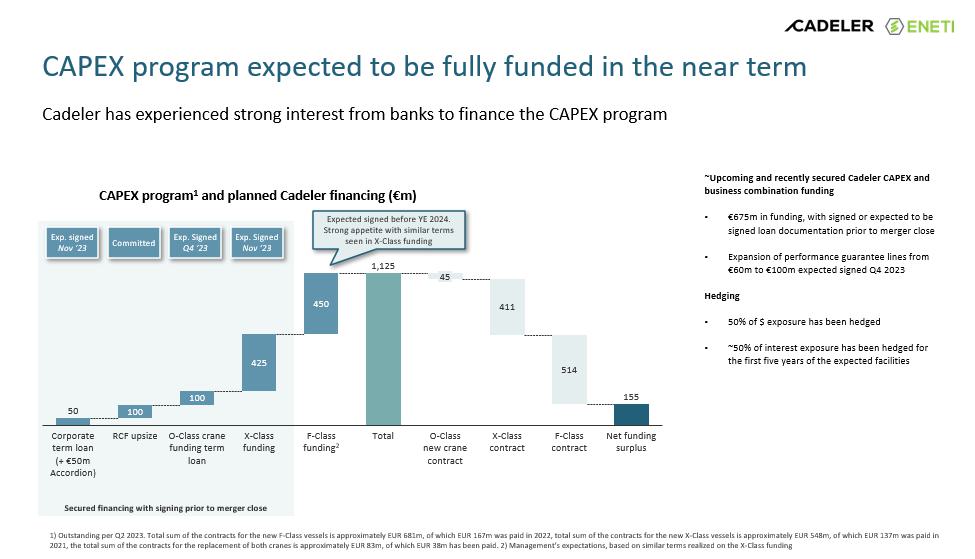

Secured financing with signing prior to merger close 1) Outstanding per Q2 2023. Total sum of the contracts for the new F - Class vessels is approximately EUR 681m, of which EUR 167m was paid in 2022, total sum of the contracts for the new X - Class vessels is approximately EUR 548m, of which EUR 137m was paid i n 2021, the total sum of the contracts for the replacement of both cranes is approximately EUR 83m, of which EUR 38m has been p aid . 2) Management’s expectations, based on similar terms realized on the X - Class funding CAPEX program expected to be fully funded in the near term Cadeler has experienced strong interest from banks to finance the CAPEX program ~ Upcoming and recently secured Cadeler CAPEX and business combination funding • €675m in funding, with signed or expected to be signed loan documentation prior to merger close • Expansion of performance guarantee lines from €60m to €100m expected signed Q4 2023 Hedging • 50% of $ exposure has been hedged • ~50% of interest exposure has been hedged for the first five years of the expected facilities 50 1,125 155 100 100 425 450 411 514 Corporate term loan (+ €50m Accordion) RCF upsize O - Class crane funding term loan X - Class funding F - Class funding 2 Total 45 O - Class new crane contract X - Class contract F - Class contract Net funding surplus CAPEX program 1 and planned Cadeler financing ( € m) Expected signed before YE 2024. Strong appetite with similar terms seen in X - Class funding Exp. signed Nov ‘23 Committed Exp. Signed Q4 ‘23 Exp. Signed Nov ‘23

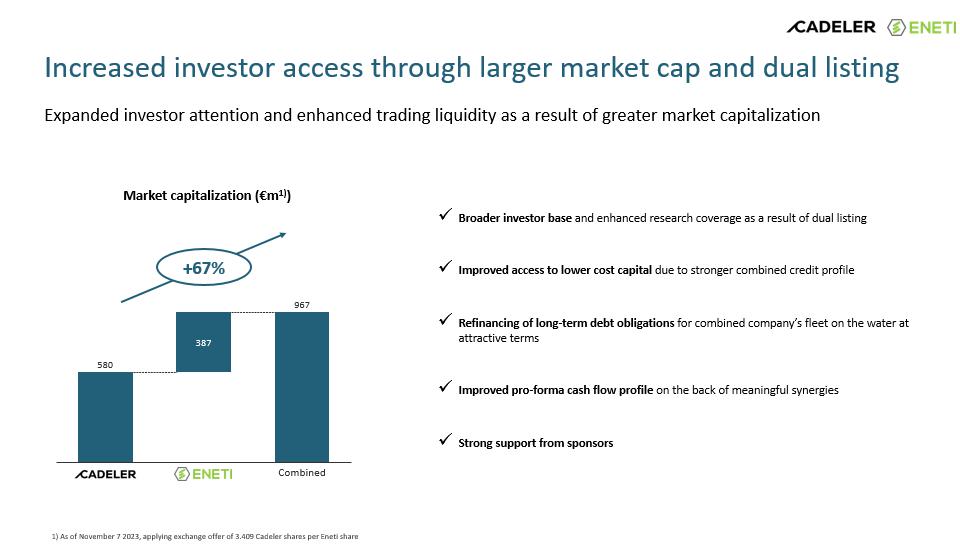

1) As of November 7 2023, applying exchange offer of 3.409 Cadeler shares per Eneti share Increased investor access through larger market cap and dual listing Expanded investor attention and enhanced trading liquidity as a result of greater market capitalization Market capitalization (€m 1) ) +67% 580 967 387 Combined x Broader investor base and enhanced research coverage as a result of dual listing x Improved access to lower cost capital due to stronger combined credit profile x Refinancing of long - term debt obligations for combined company’s fleet on the water at attractive terms x Improved pro - forma cash flow profile on the back of meaningful synergies x Strong support from sponsors

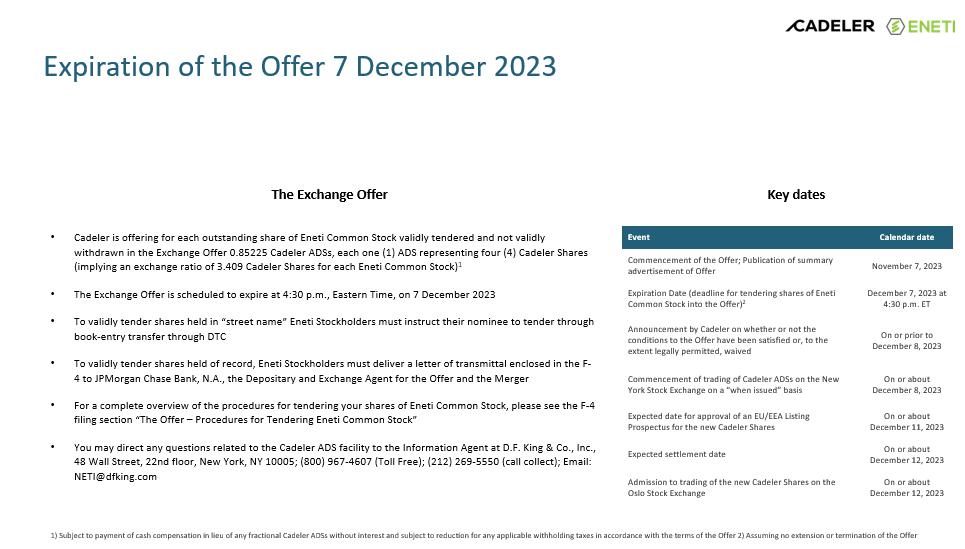

1) Subject to payment of cash compensation in lieu of any fractional Cadeler ADSs without interest and subject to reduction for any applicable withholding taxes in accordance with the terms of the Offer 2) Assuming no extension or termination of the Offer Expiration of the Offer 7 December 2023 • Cadeler is offering for each outstanding share of Eneti Common Stock validly tendered and not validly withdrawn in the Exchange Offer 0.85225 Cadeler ADSs, each one (1) ADS representing four (4) Cadeler Shares (implying an exchange ratio of 3.409 Cadeler Shares for each Eneti Common Stock) 1 • The Exchange Offer is scheduled to expire at 4:30 p.m., Eastern Time, on 7 December 2023 • To validly tender shares held in “street name” Eneti Stockholders must instruct their nominee to tender through book - entry transfer through DTC • To validly tender shares held of record, Eneti Stockholders must deliver a letter of transmittal enclosed in the F - 4 to JPMorgan Chase Bank, N.A., the Depositary and Exchange Agent for the Offer and the Merger • For a complete overview of the procedures for tendering your shares of Eneti Common Stock, please see the F - 4 filing section “The Offer – Procedures for Tendering Eneti Common Stock” • You may direct any questions related to the Cadeler ADS facility to the Information Agent at D.F. King & Co., Inc., 48 Wall Street, 22nd floor, New York, NY 10005; (800) 967 - 4607 (Toll Free); (212) 269 - 5550 (call collect); Email: NETI@dfking.com The Exchange Offer Key dates Event Calendar date Commencement of the Offer; Publication of summary advertisement of Offer November 7, 2023 Expiration Date (deadline for tendering shares of Eneti Common Stock into the Offer) 2 December 7, 2023 at 4:30 p.m. ET Announcement by Cadeler on whether or not the conditions to the Offer have been satisfied or, to the extent legally permitted, waived On or prior to December 8, 2023 Commencement of trading of Cadeler ADSs on the New York Stock Exchange on a “when issued” basis On or about December 8, 2023 Expected date for approval of an EU/EEA Listing Prospectus for the new Cadeler Shares On or about December 11, 2023 Expected settlement date On or about December 12, 2023 Admission to trading of the new Cadeler Shares on the Oslo Stock Exchange On or about December 12, 2023

Agenda 2) Combination overview 3 ) Company and financial update 1) Introduction to Cadeler 4) Market outlook

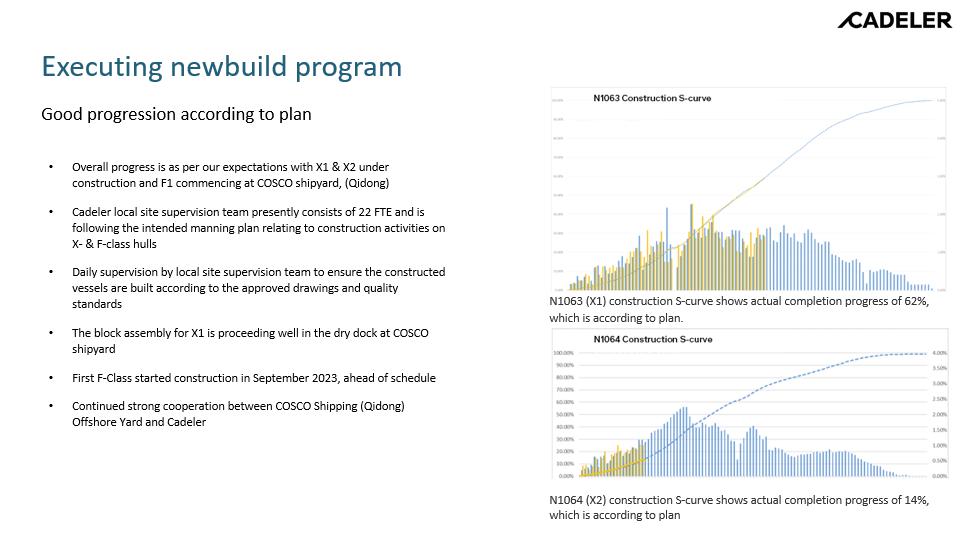

Executing newbuild program Good progression according to plan • Overall progress is as per our expectations with X1 & X2 under construction and F1 commencing at COSCO shipyard, ( Qidong ) • Cadeler local site supervision team presently consists of 22 FTE and is following the intended manning plan relating to construction activities on X - & F - class hulls • Daily supervision by local site supervision team to ensure the constructed vessels are built according to the approved drawings and quality standards • The block assembly for X1 is proceeding well in the dry dock at COSCO shipyard • First F - Class started construction in September 2023, ahead of schedule • Continued strong cooperation between COSCO Shipping ( Qidong ) Offshore Yard and Cadeler N1063 (X1) construction S - curve shows actual completion progress of 62%, which is according to plan. N1064 (X2) construction S - curve shows actual completion progress of 14%, which is according to plan

Executing O - Class crane project Preparation and planning on track, according to plan Team – (fully operational) • Cadeler Team including Site Team is in place • “Rehearsal of Concept” has been carried out with all major project stakeholders simulating demobilization/mobilization work of old and new cranes at the port of Rotterdam • Close cooperation with external and internal stakeholders continues Fabrication of cranes in Korea • 1 st Crane (Wind Orca) has been completed in Korea and now in transit to Europe • 2 nd Crane (Wind Osprey) ready for shipment from Korea Q3 / 2023 Demobilization/mobilization (Planning & Coordination continues) • Wind Orca – New crane installed onboard and ready Q1 / 2024 • Wind Osprey – New crane installed onboard and ready Q1 / 2024

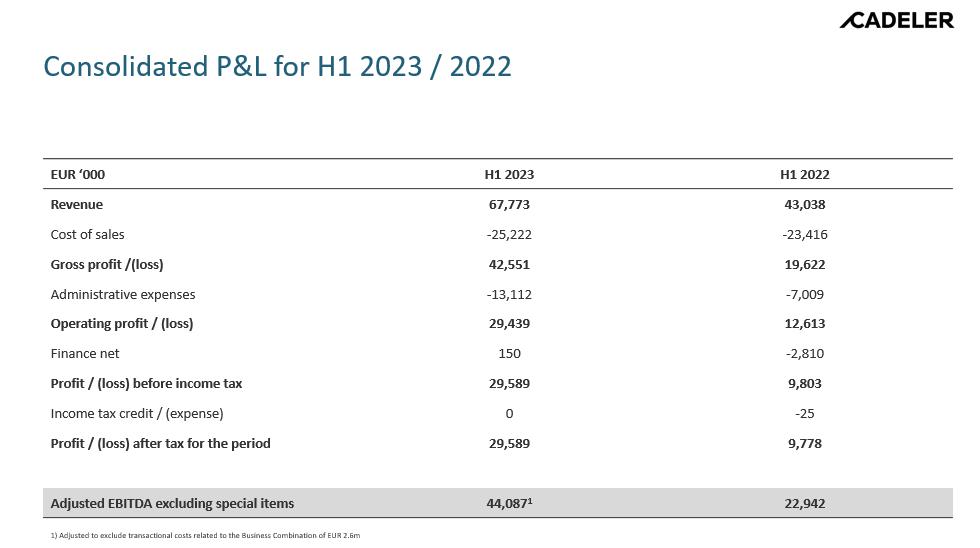

1) Adjusted to exclude transactional costs related to the Business Combination of EUR 2.6m Consolidated P&L for H1 2023 / 2022 EUR ‘000 H1 2023 H1 2022 Revenue 67,773 43,038 Cost of sales - 25,222 - 23,416 Gross profit /(loss) 42,551 19,622 Administrative expenses - 13,112 - 7,009 Operating profit / (loss) 29,439 12,613 Finance net 150 - 2,810 Profit / (loss) before income tax 29,589 9,803 Income tax credit / (expense) 0 - 25 Profit / (loss) after tax for the period 29,589 9,778 Adjusted EBITDA excluding special items 44,087 1 22,942

Consolidated Balance Sheet for H1 2023 / 2022 EUR ‘000 H1 2023 H1 2022 Non - Current Assets 617,171 507,164 Cash and Cash Equivalents 19,052 114 Other Current Assets 61,972 15,695 Total Assets 698,195 522,973 Equity 563,827 417,712 Non - current Liabilities 125,233 37,695 Current Liabilities 9,135 67,566 Total Equity and Liabilities 698,195 522,973

Agenda 2) Combination overview 3) Company and financial update 1) Introduction to Cadeler 4 ) Market outlook

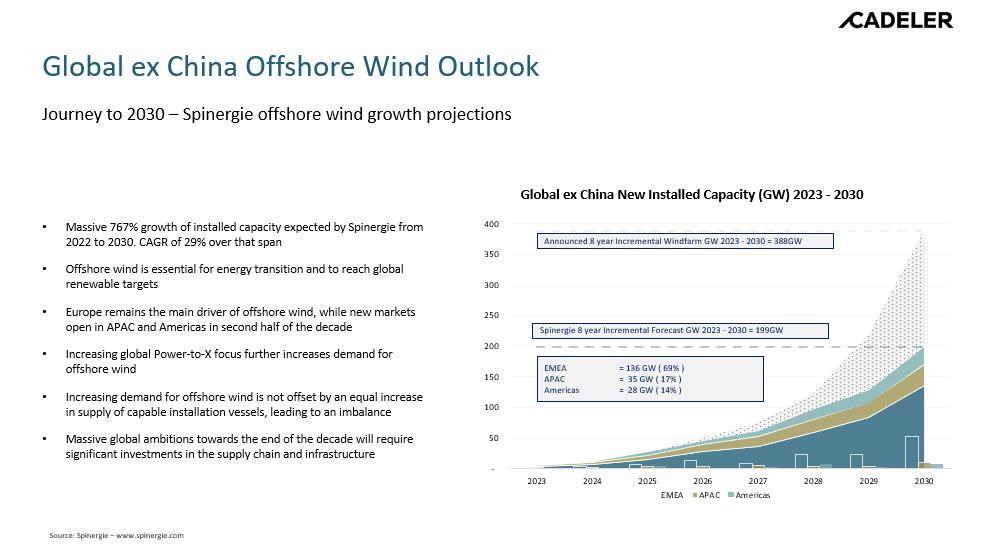

• Massive 767% growth of installed capacity expected by Spinergie from 2022 to 2030. CAGR of 29% over that span • Offshore wind is essential for energy transition and to reach global renewable targets • Europe remains the main driver of offshore wind, while new markets open in APAC and Americas in second half of the decade • Increasing global Power - to - X focus further increases demand for offshore wind • Increasing demand for offshore wind is not offset by an equal increase in supply of capable installation vessels, leading to an imbalance • Massive global ambitions towards the end of the decade will require significant investments in the supply chain and infrastructure Source: Spinergie – www.spinergie.com Global ex China Offshore Wind Outlook Journey to 2030 – Spinergie offshore wind growth projections Global ex China New Installed Capacity (GW) 2023 - 2030 - 50 100 150 200 250 300 350 400 2023 2024 2025 2026 2027 2028 2029 2030 EMEA APAC Americas Announced 8 year Incremental Windfarm GW 2023 - 2030 = 388GW Spinergie 8 year Incremental Forecast GW 2023 - 2030 = 199GW EMEA = 136 GW ( 69% ) APAC = 35 GW ( 17% ) Americas = 28 GW ( 14% )

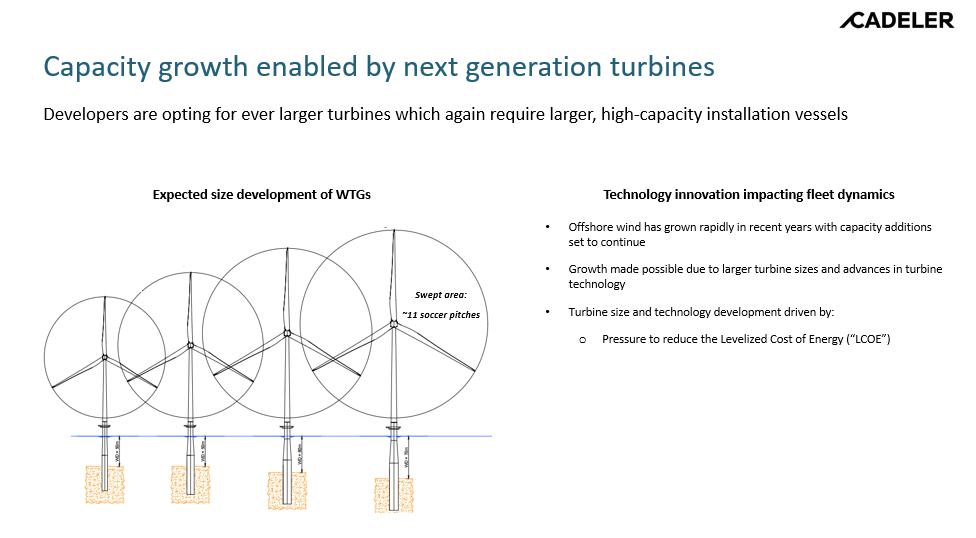

Capacity growth enabled by next generation turbines Developers are opting for ever larger turbines which again require larger, high - capacity installation vessels Technology innovation impacting fleet dynamics Expected size development of WTGs Swept area: ~11 soccer pitches • Offshore wind has grown rapidly in recent years with capacity additions set to continue • Growth made possible due to larger turbine sizes and advances in turbine technology • Turbine size and technology development driven by: o Pressure to reduce the Levelized Cost of Energy (“LCOE”)

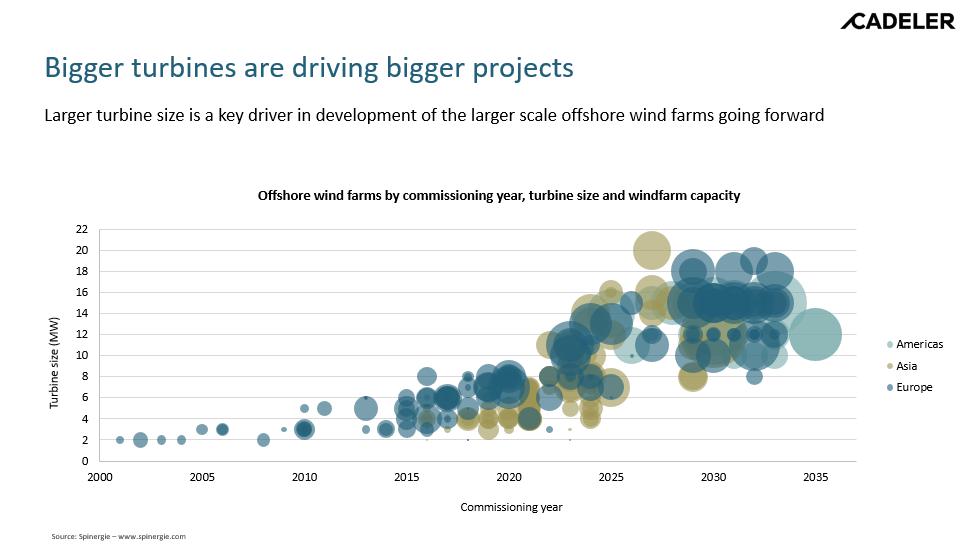

Source: Spinergie – www.spinergie.com Bigger turbines are driving bigger projects Larger turbine size is a key driver in development of the larger scale offshore wind farms going forward Offshore wind farms by commissioning year, turbine size and windfarm capacity 0 2 4 6 8 10 12 14 16 18 20 22 2000 2005 2010 2015 2020 2025 2030 2035 Turbine size (MW) Commissioning year Americas Asia Europe

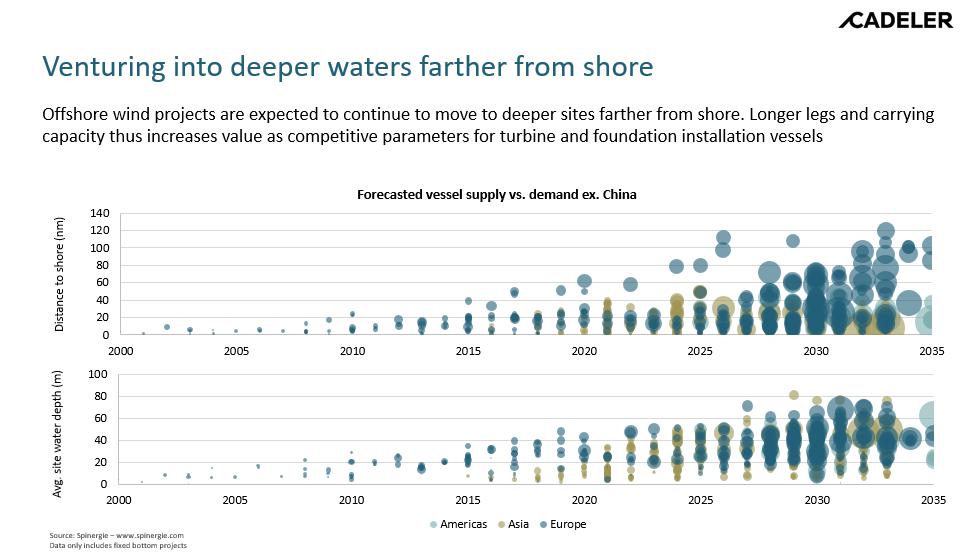

Source: Spinergie – www.spinergie.com Data only includes fixed bottom projects Venturing into deeper waters farther from shore Offshore wind projects are expected to continue to move to deeper sites farther from shore. Longer legs and carrying capacity thus increases value as competitive parameters for turbine and foundation installation vessels Forecasted vessel supply vs. demand ex. China 0 20 40 60 80 100 2000 2005 2010 2015 2020 2025 2030 2035 Avg. site water depth (m) Americas Asia Europe 0 20 40 60 80 100 120 140 2000 2005 2010 2015 2020 2025 2030 2035 Distance to shore (nm)

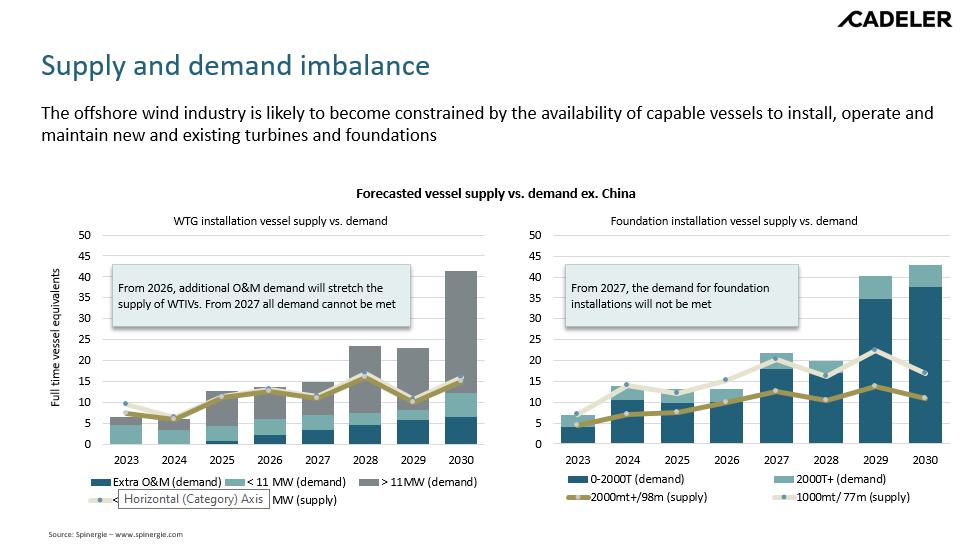

Source: Spinergie – www.spinergie.com Supply and demand imbalance The offshore wind industry is likely to become constrained by the availability of capable vessels to install, operate and maintain new and existing turbines and foundations Forecasted vessel supply vs. demand ex. China 0 5 10 15 20 25 30 35 40 45 50 2023 2024 2025 2026 2027 2028 2029 2030 Full time vessel equivalents Extra O&M (demand) < 11 MW (demand) > 11MW (demand) < 11 MW (supply) > 11 MW (supply) 0 5 10 15 20 25 30 35 40 45 50 2023 2024 2025 2026 2027 2028 2029 2030 0-2000T (demand) 2000T+ (demand) 2000mt+/98m (supply) 1000mt/ 77m (supply) From 2027, the demand for foundation installations will not be met From 2026, additional O&M demand will stretch the supply of WTIVs. From 2027 all demand cannot be met WTG installation vessel supply vs. demand Foundation installation vessel supply vs. demand