EXHIBIT 99.1

Published on November 26, 2024

|

Investor Presentation Q3 2024 1 July – 30 September 2024 Doc 2 Exhibit 99.1 |

|

Disclaimer THIS PRESENTATION (THIS "PRESENTATION") HAS BEEN PREPARED BY CADELER A/S (THE "COMPANY") EXCLUSIVELY FOR INFORMATION PURPOSES AND MAY NOT BE REPRODUCED OR REDISTRIBUTED, IN WHOLE OR IN PART, BY ANY OTHER PERSON. FORWARD-LOOKING STATEMENTS THIS PRESENTATION CONTAINS CERTAIN FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF SECTION 27A OF THE U.S. SECURITIES ACT OF 1933 AND SECTION 21E OF THE U.S. EXCHANGE ACT OF 1934, EACH AS AMENDED. ALL STATEMENTS OTHER THAN STATEMENTS OF HISTORICAL FACT INCLUDED IN THIS PRESENTATION ARE FORWARD LOOKING STATEMENTS, INCLUDING THOSE REGARDING FUTURE GUIDANCE, SUCH AS THOSE RELATED TO ANTICIPATED REVENUE, EBITDA AND ADJUSTED EBITDA. FORWARD LOOKING STATEMENTS INVOLVE RISKS, UNCERTAINTIES AND ASSUMPTIONS, AND ACTUAL RESULTS MAY DIFFER MATERIALLY FROM ANY FUTURE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD LOOKING STATEMENTS. WORDS SUCH AS "ANTICIPATE," "BELIEVE ," "CONTINUE," "COULD,“ "ESTIMATE," "EXPECT," "INTEND," "MAY," "MIGHT,“ “FORECAST”, “ON TRACK,” "PLAN," “POSSIBLE,” “POTENTIAL,” “PREDICT,” "PROJECT," "SHOULD," "WOULD," "SHALL," “TARGET,” "WILL" AND SIMILAR EXPRESSIONS ARE INTENDED TO ASSIST IN IDENTIFYING FORWARD LOOKING STATEMENTS. ALTHOUGH THE COMPANY BELIEVES THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE, THERE CAN BE NO ASSURANCE THAT SUCH EXPECTATIONS WILL PROVE TO BE CORRECT. ALL FORWARD-LOOKING STATEMENTS INCLUDED IN THIS PREENTATION SPEAK ONLY AS OF THE DATE OF THIS PRESENTATION AND THE COMPANY UNDERTAKES NO OBLIGATION TO REVISE OR UPDATE ANY FORWARD-LOOKING STATEMENT FOR ANY REASON, EXCEPT AS REQUIRED BY LAW. RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO, THOSE DETAILED IN THE COMPANY’S MOST RECENT ANNUAL REPORT ON FORM 20-F AND IN ITS OTHER FILINGS WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION. YOU SHOULD CONSIDER THESE RISKS AND UNCERTAINTIES WHEN EVALUATING THE COMPANY AND ITS PROSPECTS. NONE OF THE COMPANY OR ANY OF ITS PARENT OR SUBSIDIARY UNDERTAKINGS OR ANY OF SUCH PERSONS’ DIRECTORS, OFFICERS OR EMPLOYEES PROVIDES ANY ASSURANCE THAT THE ASSUMPTIONS REFLECTED IN THE FORWARD-LOOKING STATEMENTS INCLUDED IN THIS PRESENTATION ARE FREE FROM ERROR NOR DOES ANY OF THEM ACCEPT ANY RESPONSIBILITY FOR THE FUTURE ACCURACY OF THE OPINIONS EXPRESSED IN THIS PRESENTATION OR THE ACTUAL OCCURRENCE OF THE FORECASTED DEVELOPMENTS. NON-IFRS PERFORMANCE MEASURES THIS PRESENTATION INCLUDES CERTAIN NON-IFRS PERFORMANCE MEASURES, INCLUDING EBITDA , ADJUSTED EBITDA, AND CONTRACT BACKLOG. SUCH NON-IFRS PERFORMANCE MEASURES ARE PRESENTED HEREIN AS THE COMPANY BELIEVES THAT SUCH MEASURES PROVIDE INVESTORS WITH ADDITIONAL USEFUL INFORMATION AND A MEANS OF UNDERSTANDING HOW THE COMPANY’S MANAGEMENT EVALUATES THE COMPANY’S OPERATING PERFORMANCE. SUCH PERFORMANCE MEASURES SHOULD NOT, HOWEVER, BE CONSIDERED IN ISOLATION FROM, AS SUBSTITUTES FOR, OR AS SUPERIOR TO FINANCIAL MEASURES PREPARED IN ACCORDANCE WITH IFRS. MOREOVER, OTHER COMPANIES MAY DEFINE NON-IFRS MEASURES DIFFERENTLY, WHICH LIMITS THE USEFULNESS OF THESE MEASURES FOR THE PURPOSE OF ANY COMPARISON WITH SUCH OTHER COMPANIES. INDUSTRY AND MARKET DATA INFORMATION CONTAINED IN THIS PRESENTATION CONCERNING THE COMPANY’S INDUSTRY AND THE MARKET IN WHICH IT OPERATES, INCLUDING GENERAL EXPECTATIONS ABOUT ITS INDUSTRY, MARKET POSITION, MARKET OPPORTUNITY AND MARKET SIZE, IS BASED ON DATA FROM VARIOUS SOURCES INCLUDING INTERNAL DATA AND ESTIMATES AS WELL AS THIRD PARTY SOURCES SUCH AS INDEPENDENT INDUSTRY PUBLICATIONS, GOVERNMENT PUBLICATIONS, AND REPORTS BY MARKET RESEARCH FIRMS OR OTHER PUBLISHED INDEPENDENT SOURCES. YOU ARE CAUTIONED NOT TO GIVE UNDUE WEIGHT TO SUCH INFORMATION. YOU ARE FURTHER ADVISED THAT ANY THIRD-PARTY INFORMATION REFERRED TO IN THIS PRESENTATION HAS NOT BEEN PREPARED SPECIFICALLY FOR INCLUSION IN THIS PRESENTATION AND WHILE THE COMPANY BELIEVES SUCH INFORMATION TO BE GENERALLY RELIABLE, IT HAS NOT UNDERTAKEN ANY INDEPENDENT INVESTIGATION TO CONFIRM THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION OR TO VERIFY THAT MORE RECENT INFORMATION IS NOT AVAILABLE. |

|

Q3 2024 - Highlights 1. Financial performance in line with expectations. Full-year Revenue guidance increased to EUR 243 - 253 million and full-year EBITDA guidance narrowed to upper end of range (EUR 115 – 125 million). 2. Our newest vessel, the Wind Peak has arrived in Europe and is already on hire. 3. Two significant new projects including second foundations project added to the contract backlog. Both are multi-vessel contracts, showcasing the strength and versatility of Cadeler’s offering. 4. Multiple O&M campaigns keeping our vessels busy between projects and maximising utilization. 5. Added complementary expertise with Thomas Thune Andersen elected as an independent director. |

|

Q3 2024 commercial highlights |

|

Vessel activity in Q3 2024 5 Wind Orca Wind Osprey Wind Scylla Wind Zaratan Wind Peak • Has completed the installation of 60 x 14.7 MW turbines on the Scottish Moray West project for Siemens Gamesa (world first installation of the SGRE 14.7 MW platform) and is continuing to work for Siemens Gamesa, having transitioned seamlessly from installation to an O&M campaign prior to her next installation project. • Continues to execute on Ørsted's German Gode Wind 3 / Borkum Riffgrund 3 project. • During the charter, it was mutually agreed to release the vessel to Siemens Gamesa for a period of 27 days to support with maintenance on the Dutch Hollandse Kust Zuid wind farm. • Ørsted called 74 additional days on Gode Wind 3. • Wind Scylla continues the installation of the Revolution Wind project for Ørsted in the United States. • Has completed installing the remaining 46 turbines on the Yunlin project in Taiwan for Siemens Gamesa and is currently preparing to work on an O&M campaign for an undisclosed customer. • Has completed her transit from China to Europe and is currently mobilizing for her first job, an O&M campaign for an undisclosed customer, prior to her first installation project. |

|

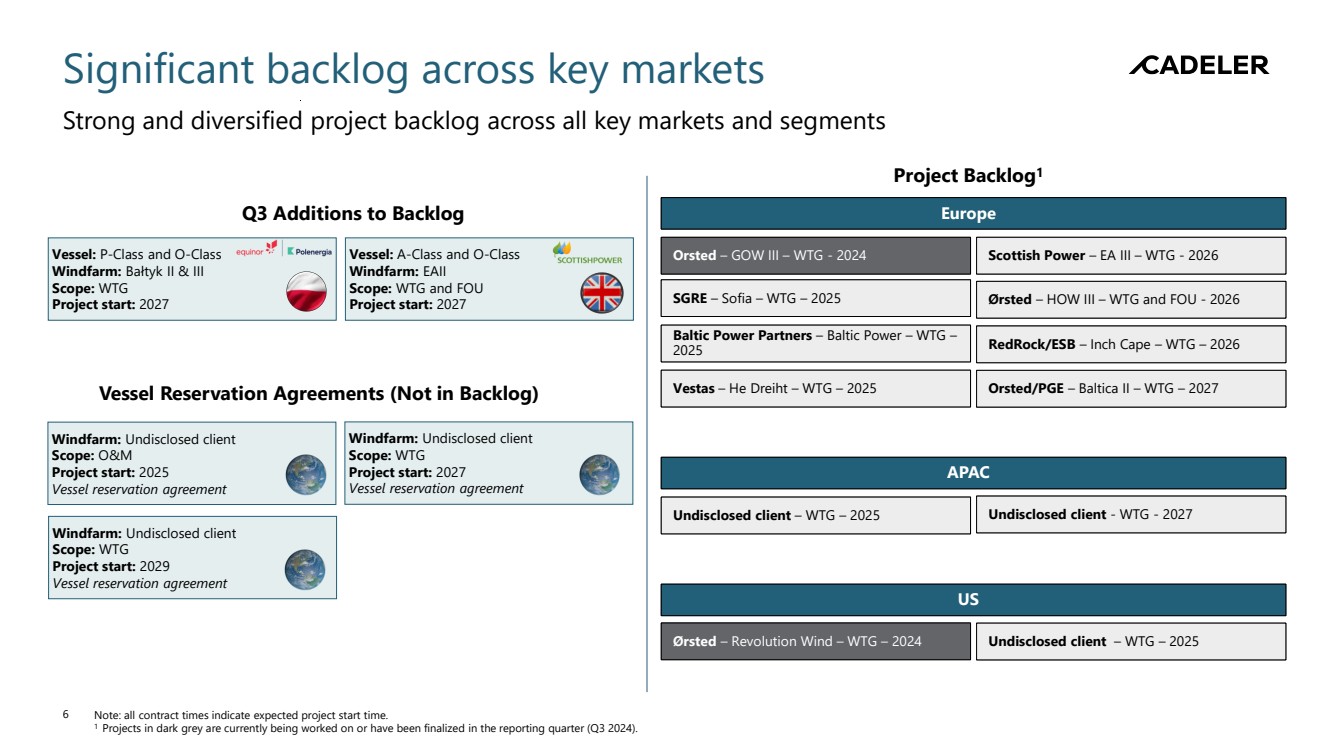

Significant backlog across key markets Strong and diversified project backlog across all key markets and segments Note: all contract times indicate expected project start time. 1 Projects in dark grey are currently being worked on or have been finalized in the reporting quarter (Q3 2024). 6 Q3 Additions to Backlog Project Backlog1 Europe APAC US Undisclosed client Undisclosed client – WTG – 2025 Ørsted – Revolution Wind Revolution Wind – WTG – 2024 Vestas – He Dreiht He Dreiht – WTG – 2025 Undisclosed client Undisclosed client - WTG - 2027 Baltic Power Partners – Baltic Power – WTG – 2025 Baltic Power Partners – Baltic Power – WTG – 2025 SGRE – Sofia – WTG – 2025 Undisclosed client Undisclosed client – WTG – 2025 Scottish Power Scottish Power – EA III – WTG - 2026 Ørsted – HOW III HOW III – WTG and FOU WTG and FOU - 2026 Orsted/PGE – Baltica Baltica II – WTG – 2027 RedRock RedRock/ESB – Inch Cape Inch Cape – WTG – 2026 Vessel Reservation Agreements (Not in Backlog) Vessel: P-Class and O-Class Windfarm: Bałtyk II & III Scope: WTG Project start: 2027 Vessel: A-Class and O-Class Windfarm: EAII Scope: WTG and FOU Project start: 2027 Windfarm: Undisclosed client Scope: WTG Project start: 2027 Vessel reservation agreement Orsted – GOW III GOW III – WTG - 2024 Windfarm: Undisclosed client Scope: WTG Project start: 2029 Vessel reservation agreement Windfarm: Undisclosed client Scope: O&M Project start: 2025 Vessel reservation agreement |

|

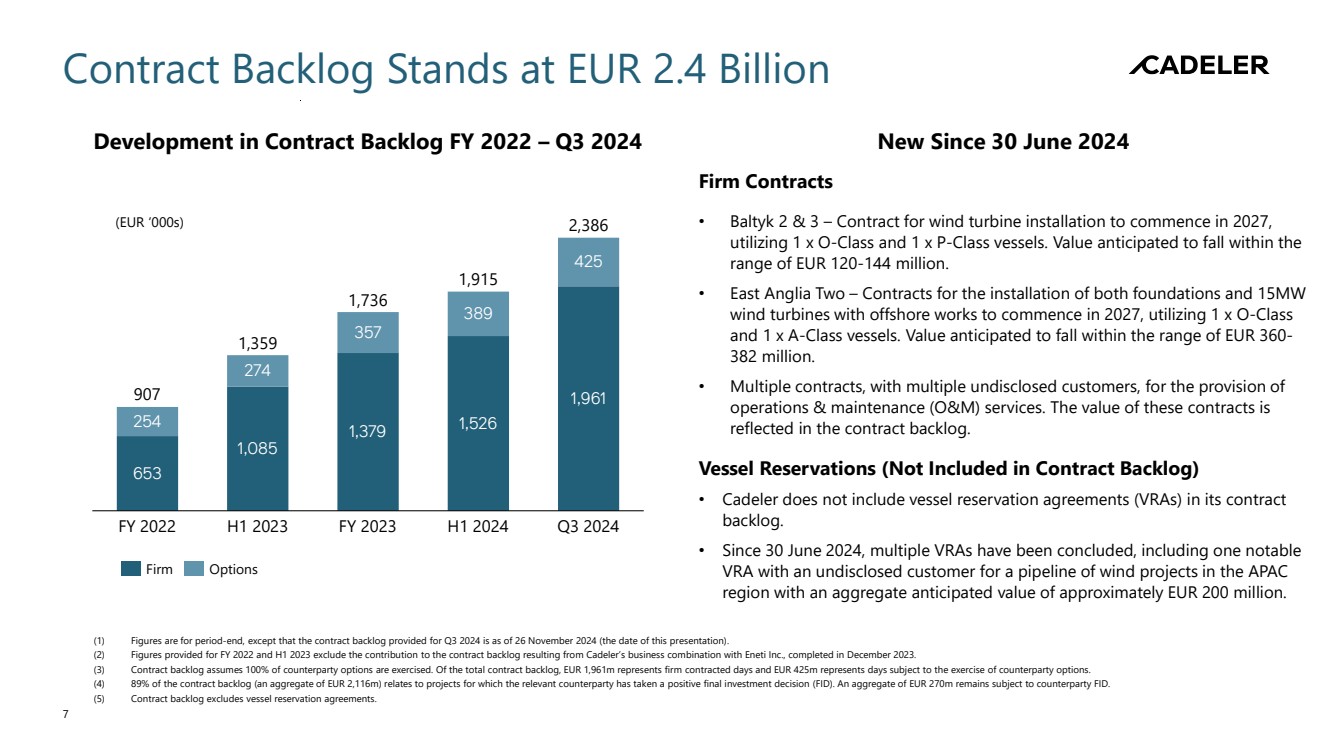

Contract Backlog Stands at EUR 2.4 Billion New Since 30 June 2024 Firm Contracts • Baltyk 2 & 3 – Contract for wind turbine installation to commence in 2027, utilizing 1 x O-Class and 1 x P-Class vessels. Value anticipated to fall within the range of EUR 120-144 million. • East Anglia Two – Contracts for the installation of both foundations and 15MW wind turbines with offshore works to commence in 2027, utilizing 1 x O-Class and 1 x A-Class vessels. Value anticipated to fall within the range of EUR 360- 382 million. • Multiple contracts, with multiple undisclosed customers, for the provision of operations & maintenance (O&M) services. The value of these contracts is reflected in the contract backlog. Vessel Reservations (Not Included in Contract Backlog) • Cadeler does not include vessel reservation agreements (VRAs) in its contract backlog. • Since 30 June 2024, multiple VRAs have been concluded, including one notable VRA with an undisclosed customer for a pipeline of wind projects in the APAC region with an aggregate anticipated value of approximately EUR 200 million. 7 Development in Contract Backlog FY 2022 – Q3 2024 (1) Figures are for period-end, except that the contract backlog provided for Q3 2024 is as of 26 November 2024 (the date of this presentation). (2) Figures provided for FY 2022 and H1 2023 exclude the contribution to the contract backlog resulting from Cadeler’s business combination with Eneti Inc., completed in December 2023. (3) Contract backlog assumes 100% of counterparty options are exercised. Of the total contract backlog, EUR 1,961m represents firm contracted days and EUR 425m represents days subject to the exercise of counterparty options. (4) 89% of the contract backlog (an aggregate of EUR 2,116m) relates to projects for which the relevant counterparty has taken a positive final investment decision (FID). An aggregate of EUR 270m remains subject to counterparty FID. (5) Contract backlog excludes vessel reservation agreements. 653 254 274 357 389 425 FY 2022 H1 2023 FY 2023 H1 2024 Q3 2024 907 1,359 1,736 1,915 2,386 1,085 1,379 1,526 1,961 Firm Options (EUR ‘000s) |

|

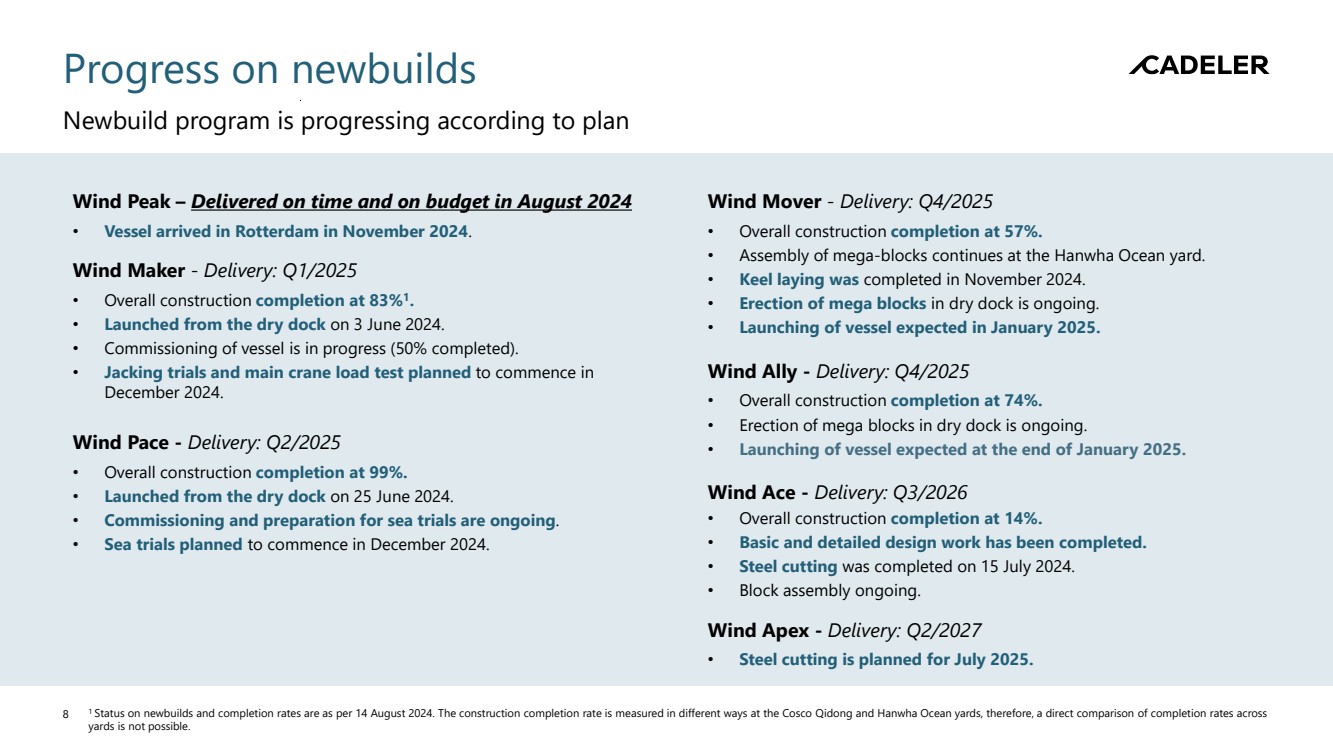

Progress on newbuilds Newbuild program is progressing according to plan 1 Status on newbuilds and completion rates are as per 14 August 2024. The construction completion rate is measured in different ways at the Cosco Qidong and Hanwha Ocean yards, therefore, a direct comparison of completion rates across yards is not possible. 8 Wind Peak – Delivered on time and on budget in August 2024 • Vessel arrived in Rotterdam in November 2024. Wind Maker - Delivery: Q1/2025 • Overall construction completion at 83%1 .. • Launched from the dry dock on 3 June 2024. • Commissioning of vessel is in progress (50% completed). • Jacking trials and main crane load test planned to commence in December 2024. Wind Pace - Delivery: Q2/2025 • Overall construction completion at 99%. • Launched from the dry dock on 25 June 2024. • Commissioning and preparation for sea trials are ongoing. • Sea trials planned to commence in December 2024. Wind Mover - Delivery: Q4/2025 • Overall construction completion at 57%. • Assembly of mega-blocks continues at the Hanwha Ocean yard. • Keel laying was completed in November 2024. • Erection of mega blocks in dry dock is ongoing. • Launching of vessel expected in January 2025. Wind Ally - Delivery: Q4/2025 • Overall construction completion at 74%. • Erection of mega blocks in dry dock is ongoing. • Launching of vessel expected at the end of January 2025. Wind Ace - Delivery: Q3/2026 • Overall construction completion at 14%. • Basic and detailed design work has been completed. • Steel cutting was completed on 15 July 2024. • Block assembly ongoing. Wind Apex - Delivery: Q2/2027 • Steel cutting is planned for July 2025. |

|

Q3 2024 financial highlights |

|

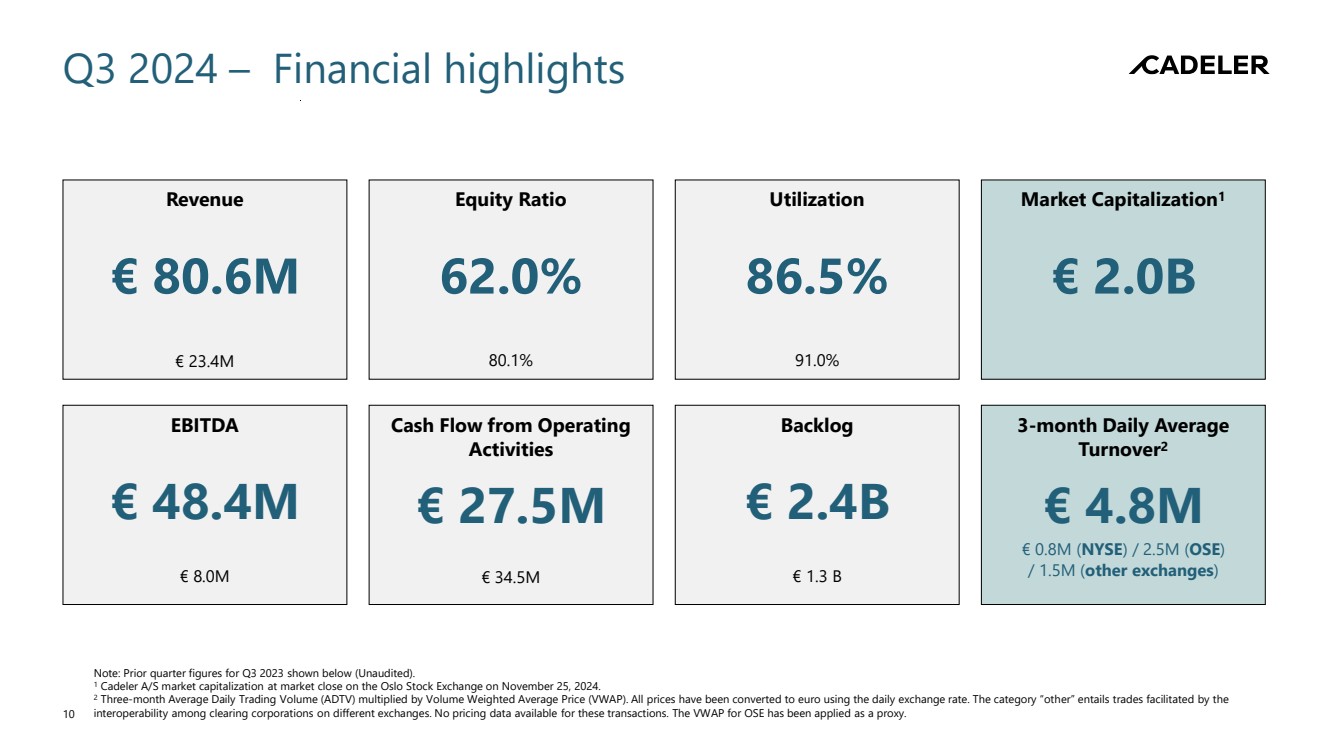

Q3 2024 – Financial highlights Note: Prior quarter figures for Q3 2023 shown below (Unaudited). 1 Cadeler A/S market capitalization at market close on the Oslo Stock Exchange on November 25, 2024. 2 Three-month Average Daily Trading Volume (ADTV) multiplied by Volume Weighted Average Price (VWAP). All prices have been converted to euro using the daily exchange rate. The category “other” entails trades facilitated by the 10 interoperability among clearing corporations on different exchanges. No pricing data available for these transactions. The VWAP for OSE has been applied as a proxy. Revenue € 80.6M € 23.4M Equity Ratio 62.0% 80.1% Utilization 86.5% 91.0% EBITDA € 48.4M € 8.0M Cash Flow from Operating Activities € 27.5M € 34.5M Backlog € 2.4B € 1.3 B Market Capitalization1 € 2.0B 3-month Daily Average Turnover2 € 4.8M € 0.8M (NYSE) / 2.5M (OSE) / 1.5M (other exchanges) |

|

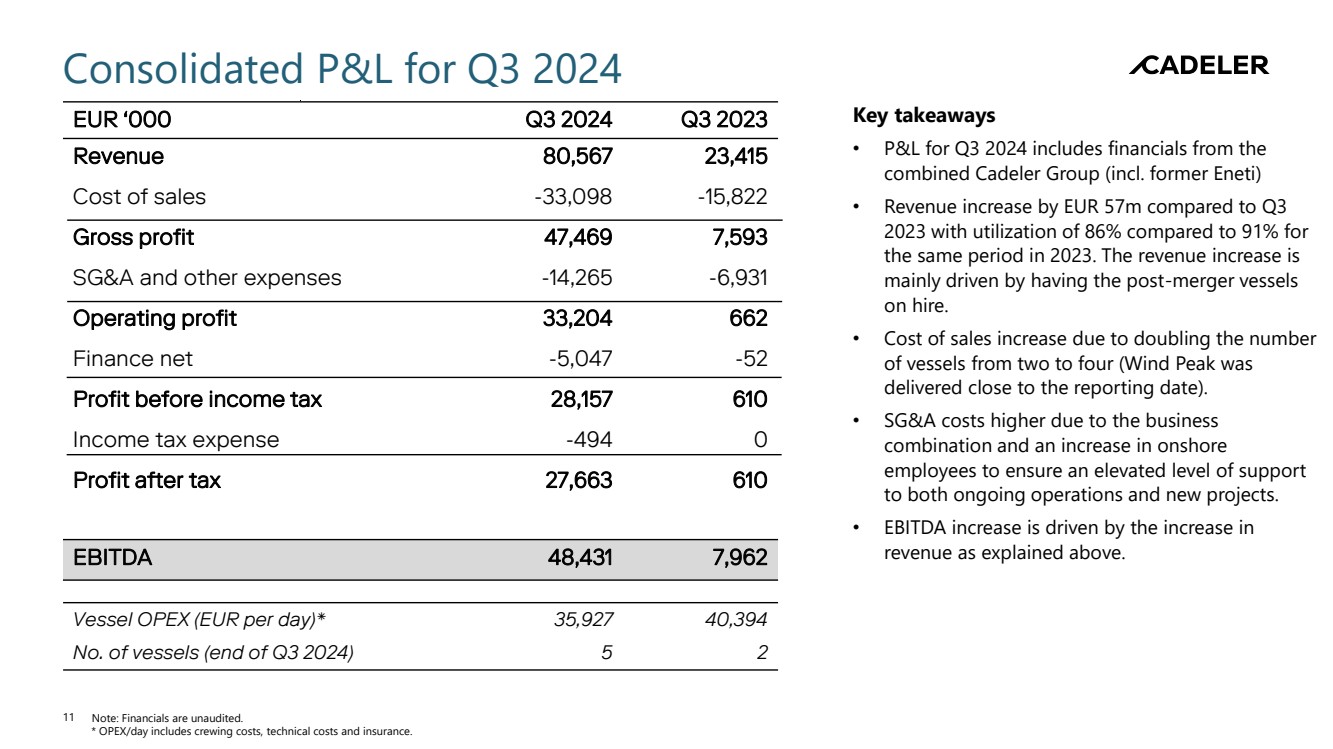

Key takeaways • P&L for Q3 2024 includes financials from the combined Cadeler Group (incl. former Eneti) • Revenue increase by EUR 57m compared to Q3 2023 with utilization of 86% compared to 91% for the same period in 2023. The revenue increase is mainly driven by having the post-merger vessels on hire. • Cost of sales increase due to doubling the number of vessels from two to four (Wind Peak was delivered close to the reporting date). • SG&A costs higher due to the business combination and an increase in onshore employees to ensure an elevated level of support to both ongoing operations and new projects. • EBITDA increase is driven by the increase in revenue as explained above. Consolidated P&L for Q3 2024 EUR ‘000 Q3 2024 Q3 2023 Revenue 80,567 23,415 Cost of sales -33,098 -15,822 Gross profit 47,469 7,593 SG&A and other expenses -14,265 -6,931 Operating profit 33,204 662 Finance net -5,047 -52 Profit before income tax 28,157 610 Income tax expense -494 0 Profit after tax 27,663 610 EBITDA 48,431 7,962 Vessel OPEX (EUR per day)* 35,927 40,394 No. of vessels (end of Q3 2024) 5 2 11 Note: Financials are unaudited. * OPEX/day includes crewing costs, technical costs and insurance. |

|

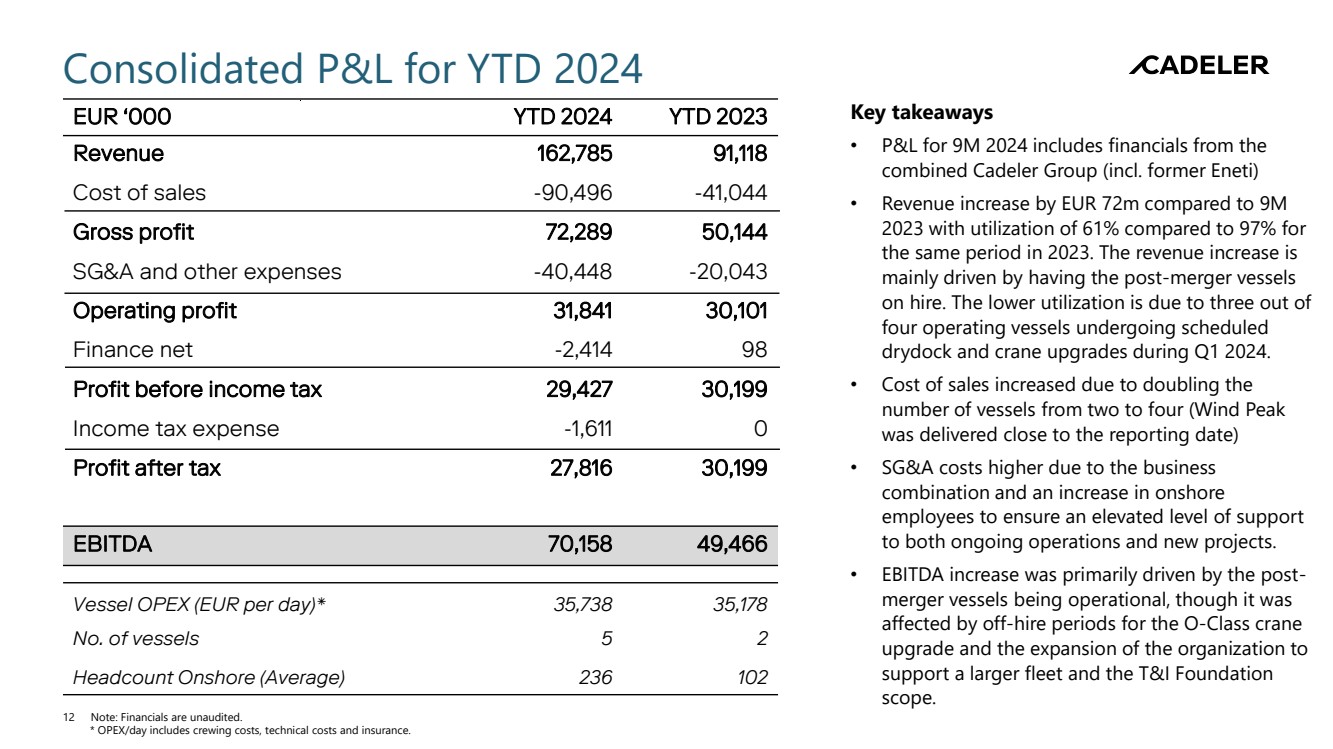

Consolidated P&L for YTD 2024 Key takeaways • P&L for 9M 2024 includes financials from the combined Cadeler Group (incl. former Eneti) • Revenue increase by EUR 72m compared to 9M 2023 with utilization of 61% compared to 97% for the same period in 2023. The revenue increase is mainly driven by having the post-merger vessels on hire. The lower utilization is due to three out of four operating vessels undergoing scheduled drydock and crane upgrades during Q1 2024. • Cost of sales increased due to doubling the number of vessels from two to four (Wind Peak was delivered close to the reporting date) • SG&A costs higher due to the business combination and an increase in onshore employees to ensure an elevated level of support to both ongoing operations and new projects. • EBITDA increase was primarily driven by the post-merger vessels being operational, though it was affected by off-hire periods for the O-Class crane upgrade and the expansion of the organization to support a larger fleet and the T&I Foundation scope. EUR ‘000 YTD 2024 YTD 2023 Revenue 162,785 91,118 Cost of sales -90,496 -41,044 Gross profit 72,289 50,144 SG&A and other expenses -40,448 -20,043 Operating profit 31,841 30,101 Finance net -2,414 98 Profit before income tax 29,427 30,199 Income tax expense -1,611 0 Profit after tax 27,816 30,199 EBITDA 70,158 49,466 Vessel OPEX (EUR per day)* 35,738 35,178 No. of vessels 5 2 Headcount Onshore (Average) 236 102 12 Note: Financials are unaudited. * OPEX/day includes crewing costs, technical costs and insurance. |

|

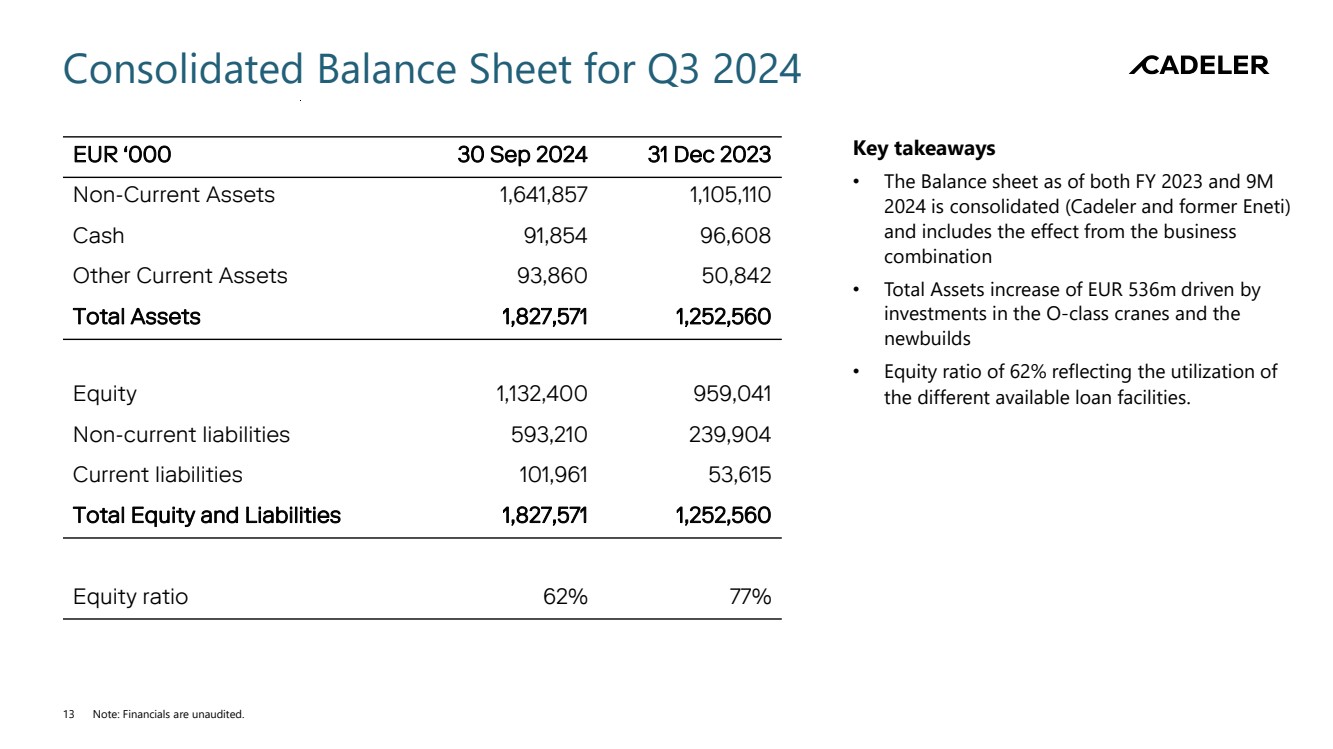

Consolidated Balance Sheet for Q3 2024 Key takeaways • The Balance sheet as of both FY 2023 and 9M 2024 is consolidated (Cadeler and former Eneti) and includes the effect from the business combination • Total Assets increase of EUR 536m driven by investments in the O-class cranes and the newbuilds • Equity ratio of 62% reflecting the utilization of the different available loan facilities. EUR ‘000 30 Sep 2024 31 Dec 2023 Non-Current Assets 1,641,857 1,105,110 Cash 91,854 96,608 Other Current Assets 93,860 50,842 Total Assets 1,827,571 1,252,560 Equity 1,132,400 959,041 Non-current liabilities 593,210 239,904 Current liabilities 101,961 53,615 Total Equity and Liabilities 1,827,571 1,252,560 Equity ratio 62% 77% 13 Note: Financials are unaudited. |

|

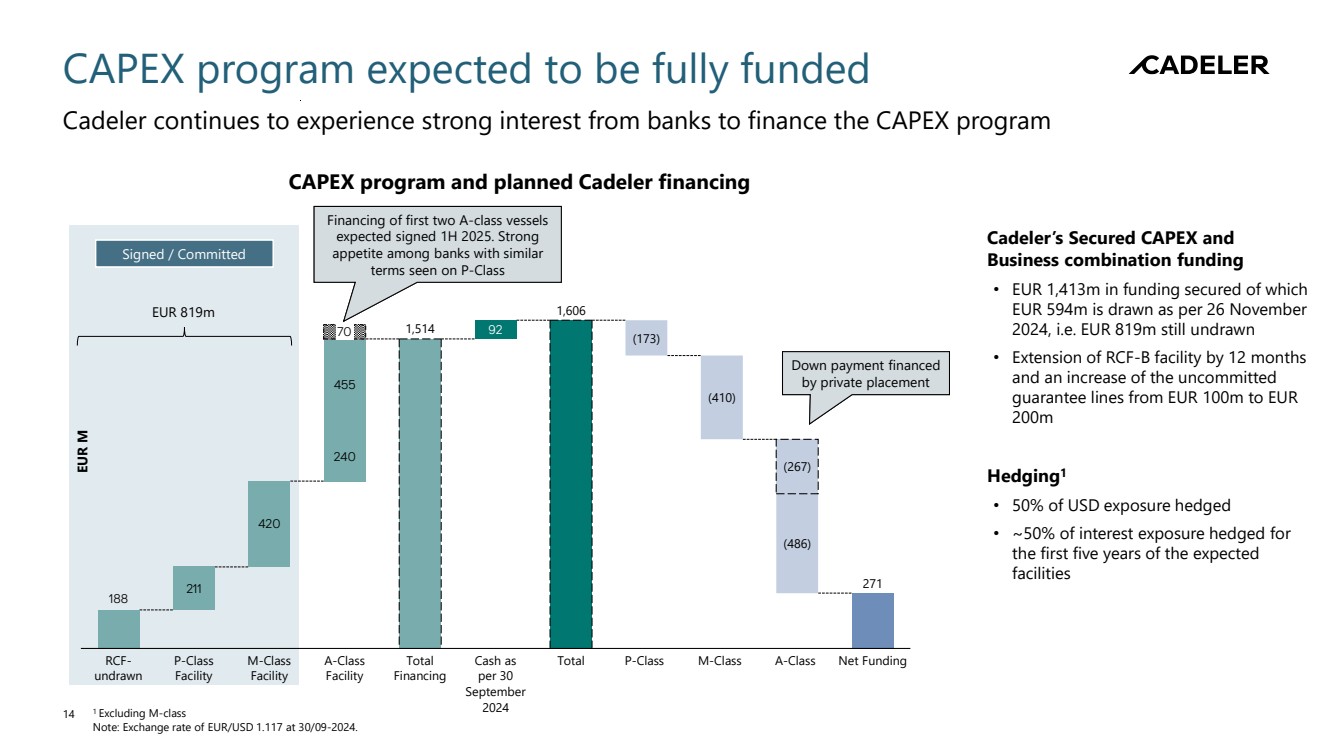

CAPEX program expected to be fully funded Cadeler continues to experience strong interest from banks to finance the CAPEX program 1 Excluding M-class Note: Exchange rate of EUR/USD 1.117 at 30/09-2024. Cadeler’s Secured CAPEX and Business combination funding • EUR 1,413m in funding secured of which EUR 594m is drawn as per 26 November 2024, i.e. EUR 819m still undrawn • Extension of RCF-B facility by 12 months and an increase of the uncommitted guarantee lines from EUR 100m to EUR 200m Hedging1 • 50% of USD exposure hedged • ~50% of interest exposure hedged for the first five years of the expected facilities EUR M 188 271 211 420 240 92 455 P-Class Facility (267) (486) M-Class A-Class Net Funding Facility 70 A-Class Facility Total Financing Cash as per 30 September 2024 Total (173) P-Class (410) RCF-undrawn 1,514 1,606 M-Class Signed / Committed CAPEX program and planned Cadeler financing 14 EUR 819m Financing of first two A-class vessels expected signed 1H 2025. Strong appetite among banks with similar terms seen on P-Class Financing of first two A-class vessels expected signed 1H 2025. Strong appetite among banks with similar terms seen on P-Class Down payment financed by private placement |

|

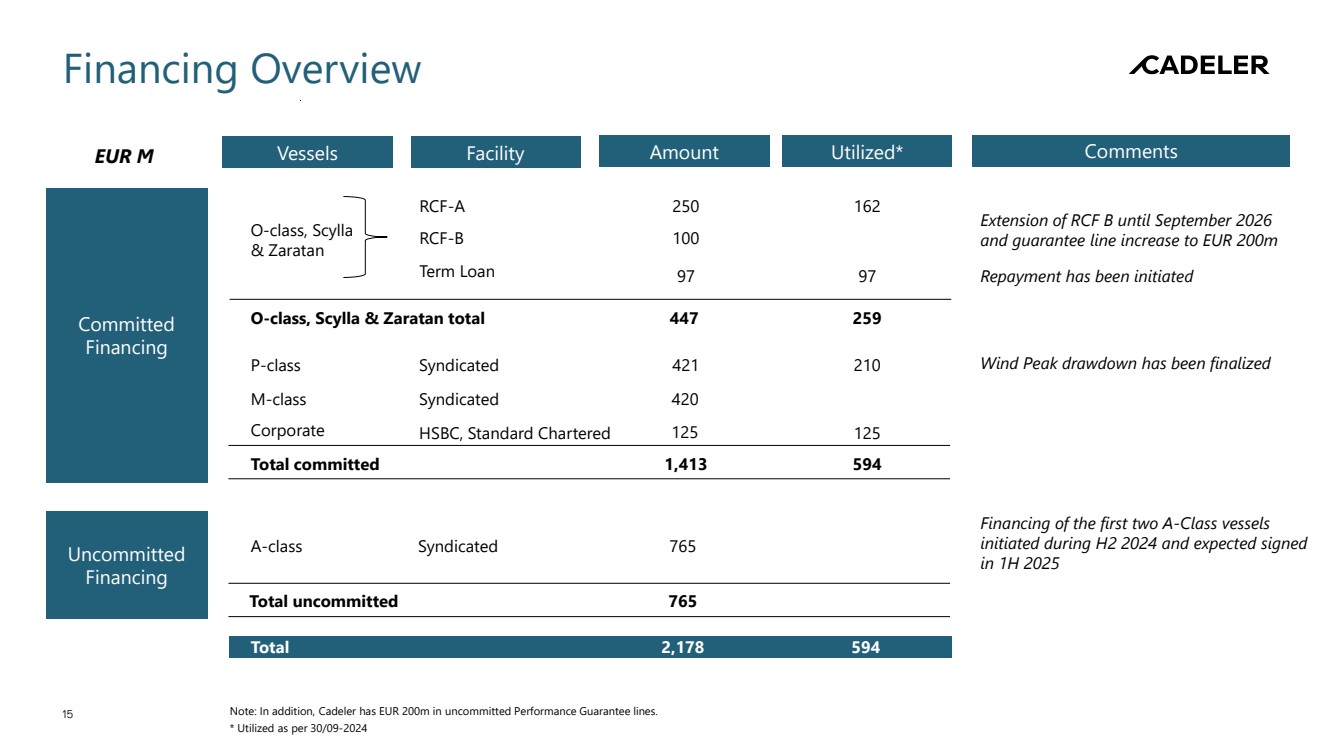

15 Note: In addition, Cadeler has EUR 200m in uncommitted Performance Guarantee lines. Committed Financing Uncommitted Financing Vessels Amount O-class, Scylla & Zaratan total 447 Total uncommitted 765 EUR M Total 2,178 Total committed 1,413 O-class, Scylla & Zaratan Repayment has been initiated Facility RCF-A 250 RCF-B 100 97 Term Loan A-class Syndicated 765 P-class Syndicated 421 Corporate HSBC, Standard Chartered 125 M-class Syndicated 420 Comments Financing of the first two A-Class vessels initiated during H2 2024 and expected signed in 1H 2025 Utilized* 594 162 125 259 594 97 Extension of RCF B until September 2026 and guarantee line increase to EUR 200m * Utilized as per 30/09-2024 Financing Overview 210 Wind Peak drawdown has been finalized |

|

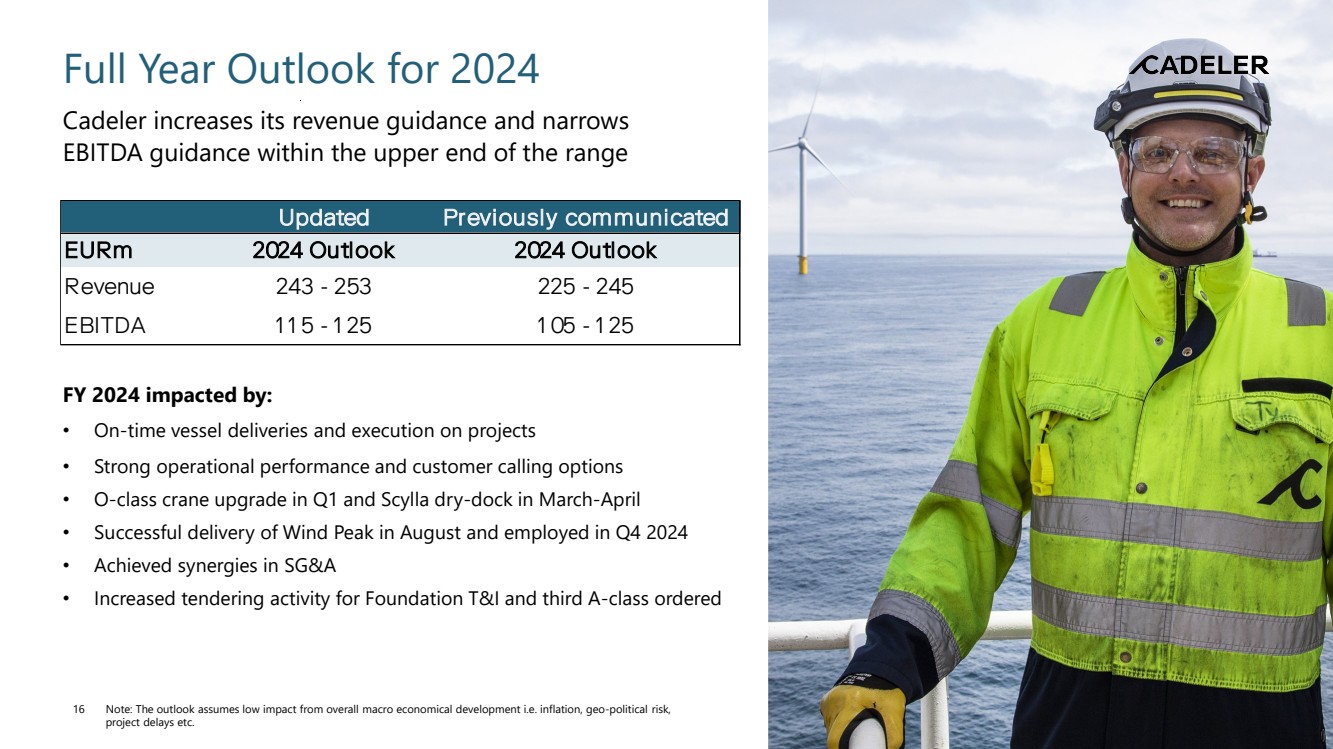

Full Year Outlook for 2024 Cadeler increases its revenue guidance and narrows EBITDA guidance within the upper end of the range FY 2024 impacted by: • On-time vessel deliveries and execution on projects • Strong operational performance and customer calling options • O-class crane upgrade in Q1 and Scylla dry-dock in March-April • Successful delivery of Wind Peak in August and employed in Q4 2024 • Achieved synergies in SG&A • Increased tendering activity for Foundation T&I and third A-class ordered Note: The outlook assumes low impact from overall macro economical development i.e. inflation, geo-political risk, project delays etc. 16 Updated Previously communicated EURm 2024 Outlook 2024 Outlook Revenue 243 - 253 225 - 245 EBITDA 1 1 5 - 1 25 1 05 - 1 25 |

|

Q2 2024 commercial outlook |

|

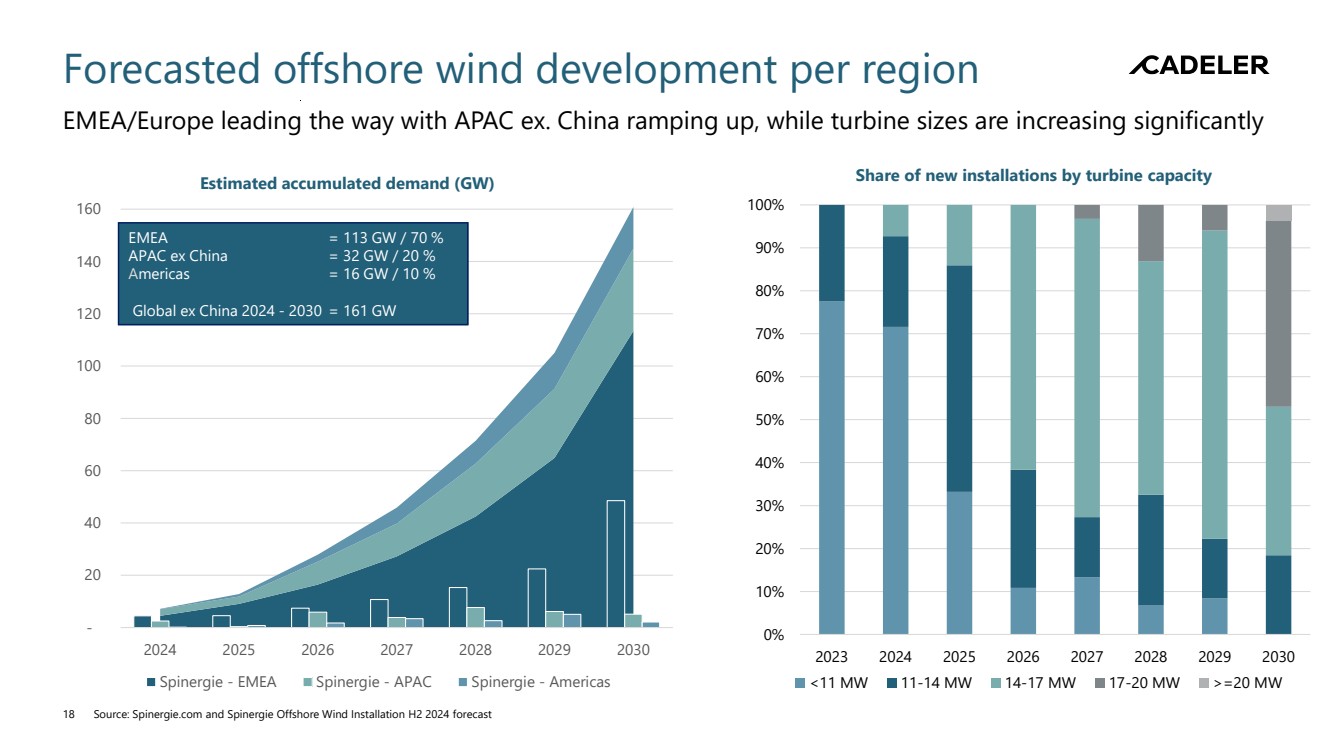

- 20 40 60 80 100 120 140 160 2024 2025 2026 2027 2028 2029 2030 Spinergie - EMEA Spinergie - APAC Spinergie - Americas Forecasted offshore wind development per region EMEA/Europe leading the way with APAC ex. China ramping up, while turbine sizes are increasing significantly 18 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2023 2024 2025 2026 2027 2028 2029 2030 <11 MW 11-14 MW 14-17 MW 17-20 MW >=20 MW Share of new installations by turbine capacity Source: Spinergie.com and Spinergie Offshore Wind Installation H2 2024 forecast EMEA = 113 GW / 70 % APAC ex China = 32 GW / 20 % Americas = 16 GW / 10 % Global ex China 2024 - 2030 = 161 GW EMEA = 113 GW / 70 % APAC ex China = 32 GW / 20 % Americas = 16 GW / 10 % Global ex China 2024 - 2030 = 161 GW Estimated accumulated demand (GW) |

|

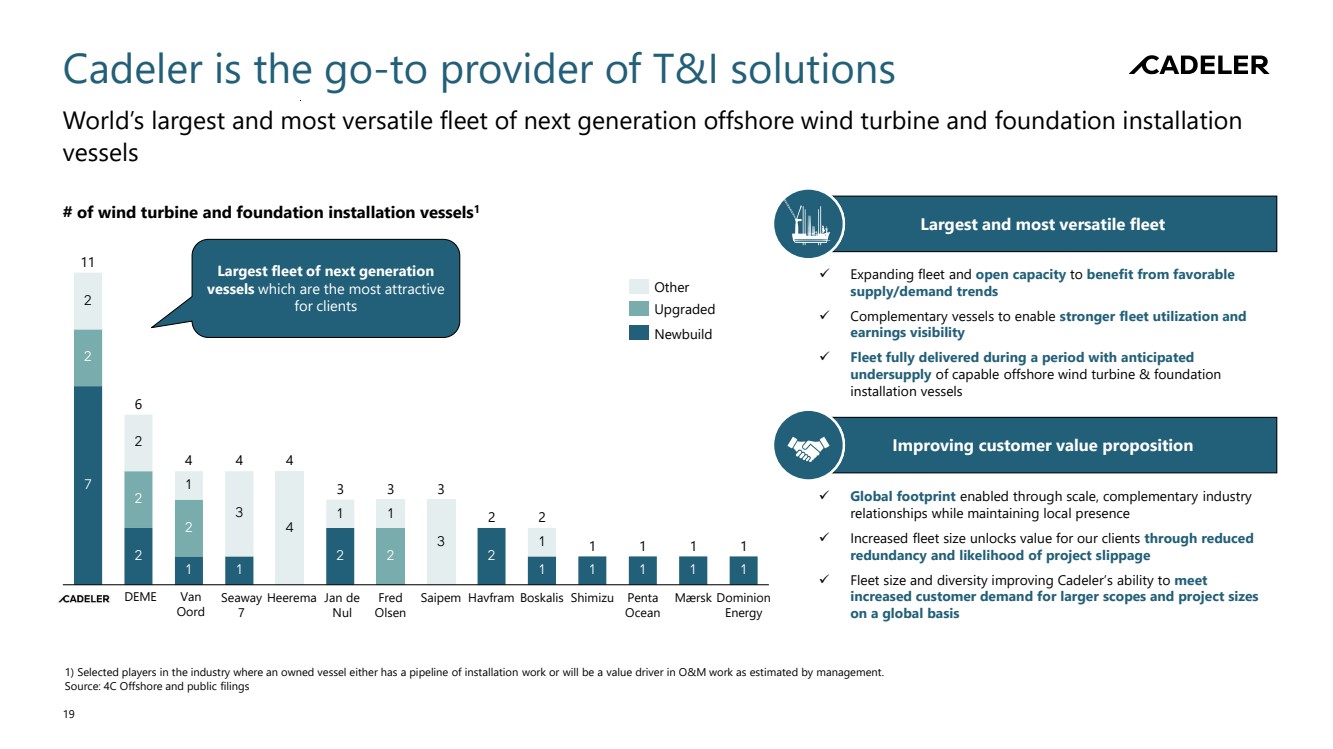

7 2 1 1 4 2 2 3 2 1 1 1 1 1 2 2 2 1 2 2 1 3 1 1 Cadeler is the go-to provider of T&I solutions World’s largest and most versatile fleet of next generation offshore wind turbine and foundation installation vessels 1) Selected players in the industry where an owned vessel either has a pipeline of installation work or will be a value driver in O&M work as estimated by management. Source: 4C Offshore and public filings Largest and most versatile fleet ✓ Expanding fleet and open capacity to benefit from favorable supply/demand trends ✓ Complementary vessels to enable stronger fleet utilization and earnings visibility ✓ Fleet fully delivered during a period with anticipated undersupply of capable offshore wind turbine & foundation installation vessels Improving customer value proposition ✓ Global footprint enabled through scale, complementary industry relationships while maintaining local presence ✓ Increased fleet size unlocks value for our clients through reduced redundancy and likelihood of project slippage ✓ Fleet size and diversity improving Cadeler’s ability to meet increased customer demand for larger scopes and project sizes on a global basis # of wind turbine and foundation installation vessels1 Largest fleet of next generation vessels which are the most attractive for clients DEME Van Oord Seaway 7 Heerema Jan de Nul Fred Olsen Saipem Havfram Boskalis Shimizu Penta Ocean Mærsk Dominion Energy 11 6 4 4 4 3 3 3 2 2 1 1 1 1 Other Upgraded Newbuild 19 |

|

Investment highlights 20 Largest, most capable and most versatile fleet in the industry. Strong complementarity in fleet enables cross-utilization, efficiency and project derisking. Highly experienced team with a proven track record, critical know-how and long-standing deep commercial relationships and contracts with the industry’s leading developers. Global growth platform with project experience and presence in all major offshore wind markets. Anticipated undersupply of capable WTG and FOU vessels from 2027 and onwards, due to significantly increasing market demand. Strong track record in the capital markets backed by a record high backlog (€2.4B) providing earnings € visibility. Key focus on being a good custodian of capital. |

|

Q & A |

|

Cadeler Kalvebod Brygge 43 DK–1560 Copenhagen Denmark +45 3246 3100 Follow us Additional questions can be sent to investorrelations@cadeler.com |