20-F: Annual and transition report of foreign private issuers pursuant to Section 13 or 15(d)

Published on March 26, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

Commission file number:

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Legal Officer

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s): |

|

Name of each exchange on which registered |

(1) |

Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of outstanding shares as of December 31, 2023 was:

Title of Class |

|

Number of Shares Outstanding |

Ordinary shares, with a nominal value of DKK 1.00 per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

☒ |

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filling:

☐U.S. GAAP

☒

☐Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐No ☐

TABLE OF CONTENTS

Page |

||

1 |

||

3 |

||

3 |

||

3 |

||

3 |

||

28 |

||

31 |

||

31 |

||

46 |

||

48 |

||

49 |

||

50 |

||

51 |

||

56 |

||

56 |

||

58 |

||

58 |

||

Material Modifications to the Rights of Security Holders and Use of Proceeds |

58 |

|

58 |

||

60 |

||

60 |

||

60 |

||

60 |

||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

60 |

|

60 |

||

61 |

||

62 |

||

Disclosures Regarding Foreign Jurisdictions that Prevent Inspections |

62 |

|

62 |

||

62 |

||

64 |

||

64 |

||

64 |

||

66 |

||

i

INTRODUCTION

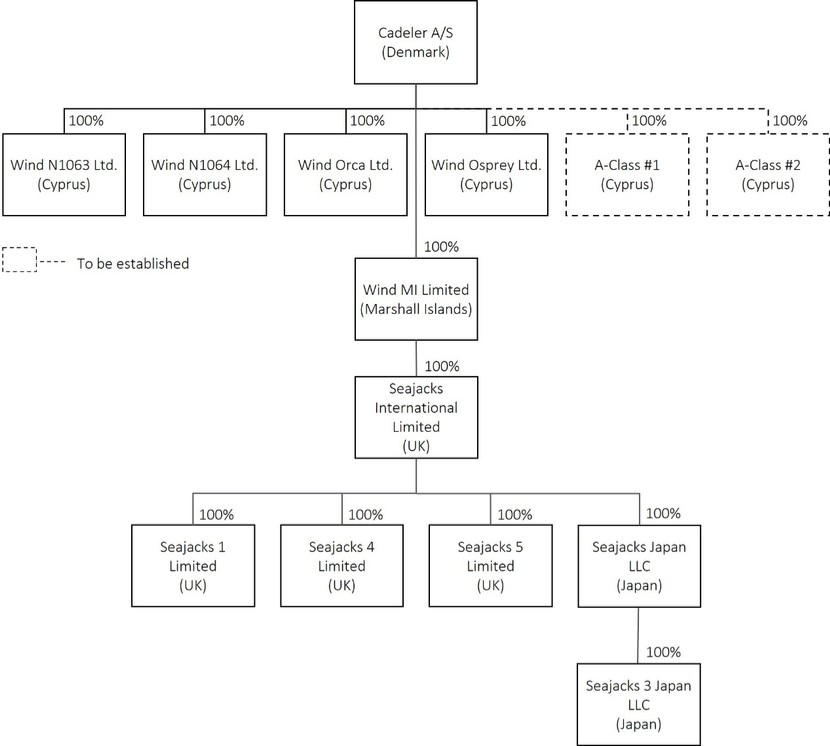

In this annual report on Form 20-F (the “Annual Report on Form 20-F”) the terms “Company” and “Cadeler” refer to Cadeler A/S, a public limited liability company incorporated under the laws of Denmark, and the term “Cadeler Group” refers to Cadeler together with its subsidiaries on a consolidated basis. The term “Cadeler Shares” refers to ordinary shares of Cadeler, each with a nominal value of DKK 1.00 per share, and the term “Cadeler ADSs” refers to Cadeler’s American Depositary Shares (“ADSs”), each of which represents four (4) Cadeler Shares.

Pursuant to Rule 12b-23(a) of the Securities Exchange Act of 1934, as amended, certain information required to be included in this Annual Report on Form 20-F is being incorporated by reference from the Company’s statutory annual report for the year ended December 31, 2023, including the consolidated financial statements of the Cadeler Group included therein (the “Annual Report 2023”), and the Company’s remuneration report for the year ended December 31, 2023 (the “Remuneration Report 2023”) as specified in this Annual Report on Form 20-F. Therefore, the information in this Annual Report on Form 20-F should be read in conjunction with the Annual Report 2023 and the Remuneration Report 2023, to the extent specified (see Exhibits 15.1 and 15.2, respectively). With the exception of the items and pages so specified, the Annual Report 2023 and Remuneration Report 2023 are not being, and shall not be deemed to be, filed as part of this Annual Report on Form 20-F.

The Company publishes its financial statements in Euros (“EUR”). The terms “USD,” “U.S. dollars” and “$” refer to the currency of the United States, the term “NOK” refers to Norwegian Kroner and the term “DKK” refers to Danish kroner.

Forward-looking statements

The information set forth in this Annual Report on Form 20-F contains “forward-looking statements” as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are generally identified by terminology such as “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “should,” “project,” “target,” “plan,” “expect,” or the negatives of these terms or variations of them or similar terminology. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are based upon current expectations, beliefs, estimates and assumptions that, while considered reasonable as and when made by Cadeler, are, by their nature, subject to significant risks and uncertainties. In addition, new risks and uncertainties may emerge from time to time, and it is not possible to predict all such risks and uncertainties. Factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statements set out herein include:

| ● | the Cadeler Group’s limited number of vessels and its vulnerability in the event of a loss of revenue relating to any such vessel(s); |

| ● | risks inherent to Cadeler’s offshore operations, |

| ● | the possibility that the utilization of the Cadeler Group’s vessels may be lower than expected and that its backlog of contracts may fail to materialize; |

| ● | contractual and non-contractual legal risks related to the Cadeler Group’s operations which may expose the Cadeler Group to financial losses and for which the Cadeler Group may not have insurance coverage; |

| ● | risks related to the ordering, construction and delivery of new build vessels and upgrades of existing vessels; |

| ● | material weaknesses in the Cadeler Group’s internal control over financial reporting; |

| ● | risks relating to technical, maintenance, transportation and other commercial services supplied to the Cadeler Group by third parties; |

| ● | increased competition and volatility in demand; |

| ● | international, national or local economic, social, political or geopolitical conditions and macroeconomic factors that could adversely affect the Cadeler Group; |

| ● | risks deriving from restrictive covenants and other conditions under Cadeler’s financing arrangements and financial risks arising generally as a result of the Cadeler Group’s level of indebtedness; |

| ● | risks relating to the failure to retain and recruit key personnel and/or to labor disruptions; |

| ● | risks relating to any failure to comply with applicable laws and regulations as well as expectations regarding environmental, social and governance as well as sustainability matters; |

| ● | risks related to Danish and U.S. taxation; |

| ● | credit, interest and exchange rate risks; |

1

| ● | any failure to realize the anticipated benefits of the Business Combination (as defined below) and risks related to the integration of the acquired business; |

| ● | the possible dilution of Cadeler Shares and Cadeler ADSs; |

| ● | the limited rights of Cadeler ADS holders; |

| ● | the ability of certain of the Cadeler Group’s largest shareholders to influence matters requiring shareholder approval and affect the price of the Cadeler Shares; and |

| ● | a lack of public information concerning Cadeler due to it being a foreign private issuer and an emerging growth company. |

These and other risks and uncertainties may cause actual results to differ materially and adversely from those expressed in any forward-looking statements. Cadeler cautions you not to place undue reliance on any forward-looking statements as they are not guarantees of future performance or outcomes. Actual performance and outcomes, including, without limitation, Cadeler’s actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which Cadeler operates, may differ materially from those made in or suggested by the forward-looking statements contained herein. Except as required by law, Cadeler does not assume any obligation to update or revise the information contained herein, which speaks only as of the date hereof.

For additional information about factors that could cause Cadeler’s results to differ materially from those described in the forward-looking statements, please see the section hereof entitled “Risk Factors” beginning on page 3 of this Annual Report on Form 20-F.

Unless required by law, Cadeler has no duty and undertakes no obligation to update or revise any forward-looking statement after the date of this document, whether as a result of new information, future events or otherwise.

Enforceability of civil liabilities

Cadeler is a public limited company incorporated under the laws of Denmark. The majority of Cadeler’s current directors and executive officers, and certain experts named herein, reside outside the United States. All or a substantial portion of Cadeler’s assets and the assets of those non-resident persons are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon Cadeler or those persons or to enforce against Cadeler or them, either inside or outside the United States, judgments obtained in U.S. courts, or to enforce in U.S. courts, judgments obtained against them in courts in jurisdictions outside the United States, in any action predicated upon the civil liability provisions of the federal securities laws of the United States.

The United States does not have a treaty with Denmark providing for reciprocal recognition and enforcement of judgments, other than arbitration awards, in civil and commercial matters. Accordingly, a final judgment for the payment of money rendered by a U.S. court based on civil liability may not be directly enforceable in Denmark. However, if the party in whose favor such final judgment is rendered brings a new lawsuit in a competent court in Denmark, that party may submit to the Danish court the final judgment that has been rendered in the United States. A judgment by a federal court or state court in the United States will neither be recognized nor enforced by a Danish court but such judgment may serve as evidence in a Danish court. It is uncertain whether Danish courts would allow actions to be predicated on the securities laws of the United States or other jurisdictions outside Denmark, and Danish courts may deny claims for punitive damages and may grant a reduced amount of damages compared to U.S. courts.

2

PART I

Item 1.Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

Item 3.Key Information

A. [Reserved]

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

Set out below is a summary of certain risk factors which could affect the Cadeler Group’s future results and may cause them to differ from expected results materially. The factors discussed below should not be regarded as a complete and comprehensive statement of all potential risks and uncertainties that the Cadeler Group’s business faces.

Risks Related to the Cadeler Group’s Business

The Cadeler Group only has a limited number of vessels and could be adversely impacted if any vessel is taken out of operation, or if there is a delay in delivery of any new build vessel.

The Cadeler Group generates revenue by utilizing its fleet for the transportation and installation of offshore wind turbine generators and foundations and the provision of operations and maintenance, accommodation, meteorological mast installation and removal and decommissioning services in the offshore wind industry. The Cadeler Group’s fleet currently consists of two windfarm O-Class vessels in operation, Wind Orca and Wind Osprey (the “Operating O-Class Vessels”), one windfarm S-Class vessel in operation, Wind Scylla (the “Operating S-Class Vessel”), and one windfarm Z-Class vessel in operation, Wind Zaratan (the “Operating Z-Class Vessel” and, together with the Operating O-Class Vessels and the Operating S-Class Vessel, the “Operating Vessels”). In addition, the Cadeler Group has ordered six new builds: two P-Class vessels (previously referred to as X-Class vessels) (the “P-Class New Builds”), two A-Class vessels (previously referred to as F-Class vessels) (the “A-Class New Builds”) and two M-Class vessels (the “M-Class New Builds” and together with the P-Class New Builds and the A-Class New Builds, the “New Builds”). Cadeler has also entered into a letter of intent with COSCO SHIPPING Heavy Industry Co. Ltd. (“COSCO”), a Chinese shipyard, for the delivery of a third A-Class New Build. If any of the Operating Vessels or, once delivered, the New Builds are temporarily or permanently taken out of operation, including due to one of the risks described in this Annual Report on Form 20-F materializing, this could result in a loss of revenue that would otherwise be generated by such vessel. In addition to a potential loss of revenue, the Cadeler Group could also be liable to its customers for liquidated damages under any charters the Cadeler Group has entered into with respect to such vessel. The loss of revenue and liability to its charterers could have a material adverse impact on the Cadeler Group’s business, prospects and financial results and condition, including its ability to be compliant with the financial covenants pursuant to its financing arrangements.

3

The Cadeler Group’s vessels may be subject to operational incidents and/or the need for upgrades, refurbishments and/or repairs following which such vessels may be out of operation for a shorter or longer period of time. For example, Wind Osprey had a crane accident in 2018 following which the vessel was out of operation for more than a year. This was due in part to the incident and in part to the Cadeler Group’s decision to design and procure an upgraded crane boom. The incident resulted in a claim from the charterers of EUR 6.25 million, while the Cadeler Group also lost estimated revenue of approximately EUR 15 million as a result of the vessel being out of operation for more than a year. The majority of the physical damage was covered by insurance. However, the vessel was required to be off-hire during the repair and upgrade process. With a fleet of only two vessels in operation at that time, an incident of this nature reduced the Cadeler Group’s earning potential by approximately 50%.

As described in the risk factor entitled “—The Cadeler Group is exposed to hazards that are inherent to offshore operations, and damages may not be covered by insurance,” the Cadeler Group experiences smaller breakdowns on an ongoing basis as part of its ordinary course of business. Any future incidents or upgrades could result in similar unavailability of the Cadeler Group’s fleet and may result in the Cadeler Group losing market share, being exposed to penalties or missing future contract opportunities as a result of shorter or longer periods of limited or no availability of the Cadeler Group’s fleet.

In addition, there is a risk that the delivery of the New Builds ordered by the Cadeler Group could be delayed. The Cadeler Group expects to take delivery of the two P-Class New Builds in the third quarter of 2024 and the second quarter of 2025, respectively, while the two A-Class New Builds on order are currently expected to be delivered in the fourth quarter of 2025 and the second half of 2026, respectively, and the two M-Class New Builds are currently expected to be delivered in the first quarter of 2025 and the fourth quarter of 2025, respectively. The Cadeler Group has contracted with COSCO for the delivery of the P-Class New Builds and the A-Class New Builds, and has entered into a letter of intent with COSCO for the construction of an additional A-Class New Build. At the same time, the Company has contracted with Hanwha Ocean Co., Ltd. (formerly Daewoo Shipbuilding & Marine Engineering Co. Ltd) (“Hanwha”) for the construction of the two M-Class New Builds. Any problems that may affect China or Korea, whether geographically or geopolitically, the general availability of components or material needed, or the relevant shipyards could lead to delayed delivery of any or all of the New Builds. For example, the COVID-19 pandemic impacted both China and the global supply chain significantly. Further, there is continuing uncertainty relating to the development of the political climate within China and between China and other countries, including the United States, for example with respect to Taiwan, as well as the global supply chain in general and whether such uncertainty will impact the delivery of the New Builds. Delayed delivery of any or all of the New Builds could delay the Cadeler Group’s generation of revenue from the utilization of such vessels and may trigger payments of liquidated damages under any charters the Cadeler Group has entered into with respect to these vessels, which may materially affect the Cadeler Group’s business, prospects and financial results and condition. See also “—The ordering, construction and delivery of new build vessels and upgrades of existing vessels is subject to various risks and uncertainties, including forward-looking assessments which could turn out to be incorrect, and requires substantial financing which may not be available at favorable terms or at all.”

From time to time, the Cadeler Group’s vessels undergo upgrades of various types to remain competitive in the market, to ensure compliance with legal requirements and to implement sustainability-related improvements. Expenditures may be incurred when repairs or upgrades are required by law, in response to an inspection by a governmental authority, when damaged, or because of market or technological developments. Such upgrades, as well as other refurbishment and repair projects, are subject to various risks, including delays and cost overruns, which could, if realized, have an adverse impact on the Cadeler Group’s available cash resources, results of operations and its ability to comply with financial covenants pursuant to its financing arrangements. To ensure timely completion of refurbishment and repair projects, the Cadeler Group may be required to allocate extra resources to the relevant project, increasing the cost of the refurbishment or repair. For example, the Cadeler Group has from time to time taken the decision to accelerate work on its vessels by adding additional resources in order to ensure the vessel was ready for its next project on time. Moreover, periods without operations for one or more of the Cadeler Group’s vessels may have a material adverse effect on the Cadeler Group’s ability to generate revenue and thereby on its business, prospects and financial results and condition.

4

The Cadeler Group is exposed to hazards that are inherent to offshore operations, and damages may not be covered by insurance.

The Cadeler Group is operating in the offshore industry and is thus subject to inherent hazards, such as breakdowns, technical problems, harsh weather conditions, environmental pollution, force majeure events (nationwide strikes, etc.), collisions and groundings. These hazards can cause personal injury or loss of life, severe damage to or destruction of property and equipment, pollution or environmental damage, claims by third parties or customers and suspension of operations. Windfarm installation vessels, including the Cadeler Group’s vessels, are also subject to hazards inherent in marine operations, either while on-site or during mobilization, such as capsizing, sinking, grounding, collision, damage from severe weather and marine life infestations. Operations may also be suspended because of machinery breakdowns, abnormal operating conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. For example, the Cadeler Group experienced a crane accident in 2018 following which the vessel involved was out of operation for more than a year causing both a claim from the charterers and lost revenue for the period. Additionally, the Cadeler Group experiences various types of technical breakdowns on an ongoing basis as part of the operation of its vessels; however, such breakdowns are typically of a smaller nature with limited downtime and impact compared to the 2018 crane incident.

The Cadeler Group’s vessels are covered by industry standard hull and machinery and protection and indemnity insurance. Standard protection and indemnity insurance for vessel owners provides limited cover for damage to project property during windfarm installation operations, as such damage is expected to be covered by the construction all risks insurance procured by the Cadeler Group’s customers. However, in recent years, the Cadeler Group has seen more contracts imposing liability for property damage on contractors such as the Cadeler Group. Such risks are difficult to adequately insure against under standard protection and indemnity insurance for vessel owners. The Cadeler Group has also considered obtaining insurance for loss-of-hire, but has evaluated and considered such insurance not to be commercially viable. As a result, certain damages and losses resulting from the aforementioned hazards may not be covered by insurance.

The Cadeler Group is dependent on the employment and utilization of its vessels, and its backlog of contracts may not materialize.

The Cadeler Group’s revenue and income are dependent on project contracts and vessel charters for the employment of its vessels. Typically, these contracts are concluded several years in advance with the terms and conditions not expected to be subject to subsequent change. Additionally, the Cadeler Group has recently experienced a trend towards reservation agreements and contracts being entered into at an earlier stage, which increases the difficulty of capturing the effect of any subsequent changes in circumstances, e.g., due to geopolitical developments and other unforeseen events. In the ordinary course of business, the Cadeler Group continuously seeks to enter into such new contracts for the employment of its vessels. The Cadeler Group has a contract backlog of existing customer contracts that imply revenues in the future, which are referred to as “firm” contracts and/or “options” for such contracts, as applicable. Such contracts and options, and revenues derived therefrom, are subject to various terms and conditions, including certain cancellation events. In addition, the exercise of options is exclusively at the discretion of the relevant customer. Such contracts and options could be subject to termination, amendments and/or delays resulting in revenues being more limited, occurring at a later time or not at all. The Cadeler Group’s current customer contracts include express cancellation rights on the part of the customers. Cancellation or termination is generally linked to a penalty or termination fee. Under its customer contracts, the Cadeler Group may also become liable to its customers for liquidated damages if there are delays in delivering a vessel for employment in connection with a project or for delays that arise during the operation of the vessels under the contracts (see also “—The Cadeler Group only has a limited number of vessels and could be adversely impacted if any vessel is taken out of operation, or if there is a delay in delivery of any new build vessel”). As of December 31, 2023, the Cadeler Group’s backlog of firm contracts and options amounted to approximately EUR 1,557 million (compared to EUR 780 million as of December 31, 2022), comprising EUR 1,379 million from fixed term contracts and EUR 178 million from options (compared to a split of EUR 653 million from firm fixed term contracts and EUR 127 million from options as of December 31, 2022).

It may also be difficult for the Cadeler Group to obtain future employment for its vessels and, as a result, utilization may decrease. Windfarm installation projects are tendered and awarded at irregular intervals and installation projects in certain locations are seasonal, particularly as a result of weather-related seasonality. Consequently, the Cadeler Group’s vessels may need to be deployed on lower-yielding work or remain idle, resulting in periods without any compensation to the Cadeler Group. There can also be off-hire periods as a consequence of accidents, technical breakdown and non-performance, as experienced with the crane accident in 2018 (see “—The Cadeler Group is exposed to hazards that are inherent to offshore operations, and damages may not be covered by insurance”) or due to maintenance or upgrades, such as the two Operating O-Class Vessels which were off-hire for approximately six months as a result of the crane upgrades nearing completion as of the date of this Annual Report on Form 20-F.

5

The cancellation, amendments to or postponement of one or more contracts can have a material adverse impact on the Cadeler Group’s revenue and may thus affect the pricing of the Cadeler Shares. For example, the Cadeler Group narrowed its guidance for the financial year ended December 31, 2022 due to upstream delay as a result of a subcontractor on a project being unable to operate as planned. While the Cadeler Group has generally not had a history of cancellations, amendments or postponement of its contracts, there can be no assurance that such cancellations, amendments or postponements will not occur in the future. As the Cadeler Group currently has only four Operating Vessels in its fleet, the Cadeler Group’s business, prospects and financial results and condition could be materially impacted if any of these vessels became disabled or otherwise unable to operate for an extended period.

The Cadeler Group faces other contractual and non-contractual legal risks related to its operations, which may expose the Cadeler Group to financial loss.

The Cadeler Group may fail to fulfil its contractual obligations under the customer contracts or other commercial contracts. For example, the Cadeler Group experienced a crane accident in 2018 following which the vessel involved was out of operation for more than a year causing both a claim from the charterers and lost revenue for the period. In addition, the Cadeler Group may be in breach of warranties made to customers if the vessels lack the required specifications or are otherwise unsuitable or unable to perform as required under the relevant contracts. In such cases, the customer contracts could be terminated and/or the Cadeler Group held liable for the relevant charterer’s losses.

Contract terms may also not be sufficient to protect the Cadeler Group from liability with respect to installation works. The Cadeler Group could be liable to third parties who are involved or have an interest in the various projects involving the Cadeler Group’s vessels. The Cadeler Group may also face claims for damages from customers based on, for example, poor workmanship. Some of these liabilities and/or losses may not be covered by the Cadeler Group’s insurance policies or otherwise indemnified.

The ordering, construction and delivery of new build vessels and upgrades to existing vessels is subject to various risks and uncertainties, including forward-looking assessments which could turn out to be incorrect, and requires substantial financing which may not be available at favorable terms or at all.

The Cadeler Group may from time to time order additional new vessels, such as the ordering of the New Builds and the entering into a letter of intent regarding the construction of an additional New Build, upgrades of existing vessels, such as the recent crane upgrades for both Operating O-Class Vessels.

The ordering, construction, supervision and delivery of such new build vessels or upgrades to existing vessels is subject to a number of risks, including the risk of cost overruns and delays. Further, when such vessels or upgraded vessels are delivered, they are subject to market risk at the time of delivery including fulfilling conditions in any pre-committed customer contracts for such vessels or upgraded vessels, and the risk of failure to secure future employment of the new or upgraded vessels at satisfactory rates, which could have a material adverse effect on the financial performance of the Cadeler Group. If the Cadeler Group is not able to procure the New Builds, similar new build vessels or vessel upgrades in the future, this could have an adverse impact on the Cadeler Group’s business, prospects and financial results and condition.

The offshore wind installation market is a fast-moving market with a relatively long leadtime on delivery of new build vessels with the specifications needed to bid on, and win, wind farm installation contracts. The Cadeler Group must correctly predict future supply of and demand for wind farm installation vessels and continuously assess the attractiveness of securing a contract for the construction of additional vessels. When making such assessments, the Cadeler Group considers a number of uncertainties and factors, including expected supply and demand (see also “—The Cadeler Group could be materially adversely affected if demand for the Cadeler Group’s services is lower than anticipated or decreases, including as a result of oversupply, changing trends in the energy market or a deterioration of the Cadeler Group’s market reputation and client relationships”), construction time, the price of construction and the expected development in construction prices, technological development in the offshore wind installation market and financing possibilities. If the Cadeler Group fails to correctly and timely assess the need for placing orders for additional vessels, the Cadeler Group may miss out on attractive contract opportunities due to capacity constraints and lose market share or incur costs of construction without being able to secure contracts for such new build vessels on commercially attractive terms or at all.

6

Ordering new build vessels will increase capital expenditures (consisting of the purchase price and associated costs) materially and thus requires significant debt or equity financing. The vast majority of the agreed construction costs for the New Builds is fixed. However, some elements of the construction contract pricing are subject to variation. As a result, the total construction costs for the New Builds could increase, and the Cadeler Group may be unable to pass on such higher costs to its customers, which could have an adverse impact on its financial results.

The aggregate capital expenditures for the New Builds are approximately EUR 1.8 billion, of which EUR 437 million has already been paid. The remaining scheduled payments will fall due during the period from 2024 to 2026. In addition, the cost of the recent crane upgrades for the Operating O-Class Vessels has been financed through the New Debt Facility (as defined below) with a term loan of up to EUR 100 million (8.5 year tenor) guaranteed by The Danish Export and Investment Fund of Denmark (EIFO). In connection with the Business Combination, the Cadeler Group acquired the New Credit Facility (as defined below) which finances approximately 65% of the purchase cost of the M-Class New Builds. On December 22, 2023, Cadeler and two of its subsidiaries, WIND N1064 Limited and WIND N1063 Limited, entered into a Sinosure-backed green term loan facility of up to EUR 425 million (12 year tenor) to finance the purchase of the P-Class New Builds (the “P-Class Facility”). Further financing will be required from 2025 in connection with milestone payments for the A-Class New Builds. The Cadeler Group’s management expects to require approximately EUR 450 million of additional funding for the A-Class New Builds. Cadeler currently has a letter of intent in place for the order of one additional A-Class New Build. There can be no guarantee that the financing of such new builds and any future upgrades can be obtained on attractive terms or at all. If the required financing is not obtained, the Cadeler Group may default on its obligations and be liable towards the relevant yard and/or other suppliers of goods and services related thereto, and the Cadeler Group may not be able to expand its fleet and thereby maintain its competitive position. The Cadeler Group may seek to obtain the required financing through capital markets or debt financing. Should the Cadeler Group not be able to secure the needed financing, in part or in whole, for example due to unattractive terms such as unfavorable interest rates, the Cadeler Group may be required to postpone future investments (including orders for new build vessels). If, in connection with an equity financing, the demand for or price of the Cadeler Shares is lower than historically experienced, this could result in significant dilution of the shareholding of existing holders of Cadeler Shares (the “Cadeler Shareholders”) and a decrease in the price of the Cadeler Shares.

The Cadeler Group typically derives its revenue from a small number of customers, and the loss or default of any such customer could result in a significant loss of revenue and adversely affect the Cadeler Group’s business.

The Cadeler Group has historically had a high customer concentration as a result of the small number of vessels in its fleet and the typical duration of its projects. For example, in 2022 and 2023, the entirety of the Cadeler Group’s revenue was generated from a small number of customers. As of December 31, 2023, the Cadeler Group’s backlog comprised ten customers. Consequently, if the Cadeler Group loses any of its most significant customers or any of them fail to pay for the services provided by the Cadeler Group or enters into bankruptcy, the Cadeler Group’s revenue could be materially adversely affected. The loss of one or more significant customers, or a decline in the number of projects or consideration paid for the Cadeler Group’s services under the Cadeler Group’s contracts with significant customers, would affect the Cadeler Group’s revenue and cash flow, and could have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition. Additionally, any delay of a project for one or more of the Cadeler Group’s most significant customers could affect the Cadeler Group’s revenue, the utilization of its vessels and potentially the ability to fulfil other contracts. Many of the Cadeler Group’s contracts contain options for additional work, which, if exercised, would generate additional revenue. If such options are not exercised to the extent the Cadeler Group expects based on its historic experience, the Cadeler Group’s revenue could be substantially lower than anticipated.

The Cadeler Group has identified material weaknesses in internal control over financial reporting. If the Cadeler Group fails to maintain an effective system of internal control over financial reporting, it may not be able to accurately report financial results in a timely manner or prevent fraud, which may adversely affect its business and the market price of the Cadeler ADSs and Cadeler Shares.

In connection with the audits of its financial statements for the years ended December 31, 2023, 2022 and 2021, the Cadeler Group and its independent registered public accounting firm have identified material weaknesses related to the Cadeler Group’s internal control over financial reporting driven by (i) a lack of formalized risk assessment and documented procedures in relation to the Company’s business processes and entity level controls, lack of evidence of performing internal controls including the completeness and accuracy of information used in the execution of controls, and lack of monitoring control activities, and (ii) lack of internal controls over change management and access management in the relevant financial information technology (“IT”) systems required to support effective internal control framework. The Cadeler Group believes that these material weaknesses continue to exist as of the date hereof.

7

As defined in the standards established by the U.S. Public Company Accounting Oversight Board (“PCAOB”), a material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Cadeler Group’s annual or interim consolidated financial statements will not be prevented or detected on a timely basis.

The material weaknesses identified relate to existing processes to assess risk and to design and implement effective control activities. In particular, the Cadeler Group does not have formalized risk assessment, oversight and compliance processes or formalized control descriptions for all key controls. Where process and control descriptions do exist, they do not necessarily include all relevant information to enable the operating effectiveness of such controls. Where control activities are dependent on IT applications or certain information or reports, currently there are no documented internal controls to assess the completeness and accuracy of such information. The Cadeler Group also does not currently monitor control activities and identified control deficiencies; thus, the Cadeler Group is unable to evaluate whether other deficiencies, individually or in combination, result in a reasonable possibility that a material misstatement of the financial statements would not be prevented or detected on a timely basis.

The Cadeler Group has recently initiated steps aimed at remediation of the identified material weaknesses and strengthening of internal controls over financial reporting such as development and implementation of formal processes, internal controls (including IT general controls covering access and change management as well as cyber risks), and documentation relating to financial reporting and expects this project to be completed in the first half of 2024, with the updated internal control framework to begin operating in the first half of 2024, although the project may take longer than currently expected. The remediation plan and actions that the Cadeler Group is taking are subject to ongoing executive management review and will also be subject to audit committee oversight.

However, the Cadeler Group’s remediation plan and related actions may not fully address the material weaknesses identified in its internal controls over financial reporting and the Cadeler Group cannot guarantee that it will be successful in remediating the material weaknesses it has identified to date. A failure to remediate such material weaknesses or a failure to discover and address any other material weaknesses or significant deficiencies in the future could result in inaccuracies in the Cadeler Group’s consolidated financial statements and impair its ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis.

Management’s certification under Section 404 of the U.S. Sarbanes Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), is included in Item 15 of this Annual Report on Form 20-F. In addition, once the Cadeler Group ceases to be an “emerging growth company,” as such term is defined in Section 2(a)(19) of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), the Cadeler Group’s independent registered public accounting firm will attest to and report on the effectiveness of the Cadeler Group’s internal control over financial reporting. Currently, the Cadeler Group expects that independent registered public accounting firm attestation requirement to be applicable beginning with its Annual Report on Form 20-F for the year ending December 31, 2024.

The Cadeler Group has recently become a public company, and its reporting obligations may place a significant strain on management, operational and financial resources, and systems for the foreseeable future. The Cadeler Group may be unable to timely complete its evaluation testing and any required remediation. As a result, the Cadeler Group anticipates investing significant resources to enhance and maintain its financial controls, reporting system and procedures over the coming years.

While documenting and testing internal control procedures, in order to satisfy the future requirements of Section 404 as applicable to the Cadeler Group, the Cadeler Group may identify other weaknesses and deficiencies in internal control over financial reporting. If the Cadeler Group fails to maintain the adequacy of its internal controls over financial reporting, as these requirements are modified, supplemented or amended from time to time, management may not be able to conclude on an ongoing basis that the Cadeler Group has effective internal control over financial reporting in accordance with Section 404.

Generally, the failure to achieve and maintain an effective internal control environment could result in material misstatements in the Cadeler Group’s financial statements and could also impair the Cadeler Group’s ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, the Cadeler Group’s business, prospects and financial results and condition, as well as the trading price of Cadeler Shares and Cadeler ADSs, may be materially and adversely affected.

8

The Cadeler Group is dependent on technical, maintenance, transportation and other commercial services from third parties.

The Cadeler Group is and will continue to be dependent on technical, maintenance, transportation and other commercial services from third parties to manage its vessels and fulfil its contractual obligations. Performance by such service providers is critical. If third-party service providers, such as those involved in assisting the Cadeler Group in seafastening design, fabrication, installation and various technical services, fail to perform at an optimal level, this could materially and adversely affect the Cadeler Group’s ability to complete its contracts, as well as its business, prospects and financial results and condition, including its ability to be compliant with the financial covenants under its financing arrangements. For example, the Cadeler Group experienced a third-party supplier being delayed in connection with the repair following Wind Osprey’s crane accident in 2018, which extended the downtime period. Additionally, the Cadeler Group narrowed its guidance for the financial year ended December 31, 2022 due to upstream delay as a result of a subcontractor on a project being unable to operate as planned. If the amount the Cadeler Group is required to pay for subcontractors, equipment or supplies exceed what has been estimated, the profitability of the commercial employment of its vessels may be adversely affected. If a subcontractor, supplier, or manufacturer fails to provide services, supplies or equipment as required under a contract for any reason, the Cadeler Group may be required to source such services, supplies or equipment from other third parties, which could lead to delays or higher prices than anticipated.

The Cadeler Group relies on third-party contractors, suppliers, vendors, joint venture partners and other parties for the engineering design, procurement of materials, equipment, and services for the performance of work on the Cadeler Group’s projects. The successful completion of these projects depends on the ability of these third parties to perform their contractual obligations and is subject to factors beyond the Cadeler Group’s control, including actions or omissions by these parties and their subcontractors. Any non-performance, or a failure by such third parties to perform their contractual obligations to a satisfactory standard could result in delays to the planned project timelines, which could in turn result in late penalties or fines being imposed on the Cadeler Group.

The Cadeler Group could be materially adversely affected by increased supply of offshore wind farm installation services as a result of new competitors entering the market or existing competitors expanding their fleet of suitable vessels.

The industry in which the Cadeler Group operates is in management’s view characterized by a limited supply of efficient offshore wind farm installation services as a limited number of vessels are available and fit for the specific needs of, and trusted by, customers. Consequently, it may be difficult or expensive for customers of the Cadeler Group to find efficient alternative suppliers for their contracts in the near term, and it may be even more difficult for customers in the long term to find trusted suppliers of efficient offshore wind farm installation vessels once the new generation of larger turbines (capable of producing 15-20MW of electricity) is being rolled out, which the Cadeler Group expects will occur towards the end of the current decade. Since supply of offshore wind farm installation services depends on the number of vessels dedicated to such services, market conditions may change significantly if one or multiple existing or new competitors of the Cadeler Group were to order new build vessels or modify existing vessels to fit the future needs of the offshore wind farm industry. It is the Cadeler Group’s assessment that over the past decade there has been a general increase in the number of players active in the wind farm industry. Should similar developments occur in the market for offshore wind farm installation, the Cadeler Group may experience increased competition. Any increase in the supply of offshore wind farm installation services may result in a decrease in the prices that the Cadeler Group is able to obtain for its services. As the Cadeler Group currently only operates within the market for offshore wind farm transportation, installation and maintenance, it is more exposed to any changes in prices within the industry or utilization of its vessels compared to those of its competitors having multiple sources of revenue. See also “—The Cadeler Group faces competition from industry participants who may have greater resources than the Cadeler Group.”

9

The Cadeler Group could be materially adversely affected if demand for the Cadeler Group’s services is lower than anticipated or decreases, including as a result of oversupply, changing trends in the energy market or a deterioration of the Cadeler Group’s market reputation and client relationships.

The Cadeler Group relies on revenue generated from windfarm installation and related maintenance. The lack of diversification in Cadeler’s sources of revenue makes the Cadeler Group vulnerable to adverse developments or periods of low demand in the market in which it operates. The demand for the Cadeler Group’s services may be volatile and is subject to variations for a number of reasons, including uncertainty in future demand and regulatory changes. For example, the U.K. market for offshore wind energy has recently experienced certain challenges, including delays in relevant supply chains and government approvals, which could adversely affect the number of projects in that market in the future, and there is a risk that similar challenges also affect other countries. In case of delays on multiple projects, it may be difficult for the Cadeler Group to adapt, which would impact its revenue stream but also potentially compliance with its financing covenants. Due to the fact that the Cadeler Group invests in capital assets with life-spans of approximately 25 years and that market visibility beyond 10 years is difficult to estimate, the Cadeler Group’s long-term performance and growth depend heavily on the supply of vessels relative to market demand. Any oversupply of vessels compared to the market demand for such vessels or similar capacity could cause contract rates to decline, and falling rates could materially adversely affect the Cadeler Group’s financial performance and results of operations. As the Cadeler Group’s vessels are highly specialized for windfarm installation, redeploying them to other sectors of the marine industry may be difficult or impossible to achieve, both practically and commercially.

The wind energy market is affected by the price and availability of other energy sources, including nuclear, coal, natural gas and oil, as well as other sources of renewable energy. To the extent renewable energy, particularly wind energy, becomes less cost-competitive due to reduced government targets, increases in the cost of wind energy, new regulations or incentives that favor alternative renewable energy, cheaper, more efficient or otherwise more attractive alternatives or otherwise, demand for wind energy and other forms of renewable energy could decrease. Slow growth or a long-term reduction in the demand for wind energy could in turn reduce the demand for the Cadeler Group’s services, which could have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition.

In addition, market reputation and customer relationships are key factors to securing contracts and establishing long-lasting customer relations. For example, it is the Cadeler Group’s assessment that its market reputation and customer relationships have enabled the Cadeler Group to secure contracts for its New Builds before they are delivered. Adverse changes to the Cadeler Group’s customer relations or market reputation could result in a decrease in demand for the Cadeler Group’s services, resulting in a significant loss of revenue and adversely affecting the Cadeler Group’s business including the ability to secure future contracts.

The Cadeler Group faces competition from industry participants who may have greater resources than the Cadeler Group.

The markets in which the Cadeler Group operates are competitive and the Cadeler Group’s business is subject to risks associated with competition from new and existing industry participants. The Cadeler Group has a number of well-established competitors, including DEME Offshore, Jan de Nul (both Belgium-headquartered), Fred. Olsen (UK-headquartered) and Van Oord (Netherlands-headquartered). In addition, there are a growing number of players with specialist vessels on order. Seaway7, Dominion Energy, Maersk and Havfram, for example, each has a newbuild vessel (or vessels) either on order or currently under construction. These companies will directly compete (and in a number of cases are already directly competing) with the Cadeler Group in tenders for wind foundation and turbine installation projects. There can be no assurances that the Cadeler Group will be able to maintain or improve its competitive position or continue to meet changes in the competitive environment, including when entering new markets. In addition, certain of the Cadeler Group’s competitors may have more resources and better access to capital than the Cadeler Group. For example, new and existing competitors may have greater financial resources, customer support, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition or more established relationships in the industry. These industry participants compete with the Cadeler Group based on, among other things, price, service portfolio, technology, location and vessel availability. There is no assurance that the Cadeler Group will have the resources and expertise to compete successfully in the future, that it will be able to succeed in the face of current or future competition, or that it will be successful when entering new markets. Increased competition in the markets where the Cadeler Group operates or which it may enter could lead to reduced profitability and/or future growth opportunities for the Cadeler Group. The failure of the Cadeler Group to secure future growth, maintain or improve its competitiveness and respond to increased competition may have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition.

10

Technological progress might render the technologies used by the Cadeler Group obsolete or less profitable.

The offshore wind sector in which the Cadeler Group operates is affected by constant technological development. To maintain a successful and profitable business, the Cadeler Group must keep pace with technological developments and changing standards to meet the evolving demands of existing and potential customers. For example, the Cadeler Group is dependent on its ability to improve existing services and installation vessels to meet future demand and anticipate and respond to major changes in technology and industry standards. If the Cadeler Group fails to adequately respond to the technological changes in its industry, make the necessary capital investments, or is not suited to offer commercially competitive products and implement commercially competitive services, the Cadeler Group’s business, prospects and financial results and condition may be adversely affected.

Competitors’ vessels have previously become obsolete due to the growth in the size of turbines only 10 years into their lifespan. Although the Cadeler Group seeks to build vessels that can be upgraded, as demonstrated by the recent crane upgrades to its two Operating O-Class Vessels, there is no certainty that such vessels will remain viable for the entirety of their planned 25-year lifespan. In addition, as the vessels are unique to the wind industry, they cannot easily be repurposed for use in other segments of the marine industry. A movement towards other energy sectors or the development of new technology could render the Cadeler Group’s vessels obsolete, and the Cadeler Group may not be able to secure alternative contracts or revenue on attractive terms, if at all.

Future customer contracts may not be obtained at all, or on materially different terms than described herein.

While the Cadeler Group has previously entered into vessel reservation agreements, preferred bidder agreements and letters of intent for contracts with customers, there can be no assurance that such vessel reservation agreements, preferred bidder agreements or letters of intent will actually result in customer contracts and revenue for the Cadeler Group, or if such contracts are entered into, that they will be entered into on the terms expected by the Cadeler Group. Although the Cadeler Group’s vessel reservation and preferred bidder agreements typically contain clauses providing for the payment of customary compensation to the Cadeler Group should such agreements not result in a firm contract in line with market practice, there can be no assurance that such compensation will be paid if and to the extent owed. Additionally, many of the Cadeler Group’s contracts include options exercisable in the sole discretion of the relevant customer, and there can be no assurance that such options will be exercised and result in additional revenue being realized.

Expected and/or estimated contract terms as indicated in this Annual Report on Form 20-F regarding specifications, commercial terms and delivery schedules are only current estimates by the Cadeler Group, and may end up being materially different than expected (if such contracts are entered into at all).

The Cadeler Group operates across multiple jurisdictions and is thereby exposed to a number of risks inherent in international operations, including political, civil or economic disturbance.

The Cadeler Group operates in multiple jurisdictions and serves a wide range of customers. As a result, the Cadeler Group is exposed to risks that are inherent to conducting international operations, some of which are due to factors beyond the Cadeler Group’s control, including:

| ● | terrorist acts, war, civil disturbances and military actions; |

| ● | seizure, nationalization or expropriation of property or equipment; |

| ● | political unrest or revolutions; |

| ● | acts of piracy; |

| ● | actions by environmental organizations; |

| ● | public health threats, and outbreaks of contagious diseases and pandemics; |

| ● | global warming and extreme weather events; |

| ● | restrictions on the ability to repatriate income or capital; |

| ● | complications associated with repairing and replacing vessels and equipment in remote locations; |

| ● | delays or difficulties in obtaining necessary visas and work permits for employees; |

| ● | wage and price controls imposed by the relevant authorities; and |

| ● | the imposition of trade barriers, moratoriums or sanctions and other forms of government regulation. |

11

Some of these risks could limit or disrupt the Cadeler Group’s operations (for example, by requiring or resulting in the evacuation of personnel, cancellation of contracts, or the loss of personnel, vessels or assets), impose practical or legal barriers to the Cadeler Group’s continued operations, or negatively impact the profitability of those operations, and could therefore have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition.

The Cadeler Group is exposed to risks related to macroeconomic factors and geopolitical conditions.

The Cadeler Group is exposed to macroeconomic factors and geopolitical conditions. The international macroeconomic situation is currently characterized by material uncertainty, mainly due to the elevated levels of public debt in many of the leading global economies, increasing interest and inflation rates, the war in Ukraine, the imposition of sanctions against Russia, conflict in the Middle East, European energy crises and global supply-chain constraints. For example, the Cadeler Group has contracted with COSCO, a Chinese shipyard, for the delivery of the New Builds, and any problems that may affect China, whether geographically or geopolitically, the general availability of components or material needed, or the shipyard itself could lead to delayed delivery of any or all New Builds (see also “—The Cadeler Group only has a limited number of vessels and could be adversely impacted if any vessel is taken out of operation, or if there is a delay in delivery of any new build vessel” and “—The ordering, construction and delivery of new build vessels and upgrades of existing vessels is subject to various risks and uncertainties, including forward-looking assessments which could turn out to be incorrect, and requires substantial financing which may not be available at favorable terms or at all”). These macroeconomic conditions have had, and continuation or further worsening of these conditions could continue to have, material effects on the global economy and capital markets and could have material adverse effects on the Cadeler Group, its business, prospects and financial results and condition. Additionally, geopolitical tensions may have an impact on the future prospects of the markets in which the Cadeler Group operates and may increase the risks associated with the Cadeler Group’s operations.

On January 31, 2020, the United Kingdom withdrew from the EU (commonly known as “Brexit”). The Cadeler Group has a number of upcoming contracts in U.K. waters, which could be threatened or complicated due to the effects of Brexit. Furthermore, the United Kingdom is one of the largest markets in Europe for offshore wind and restrictions on market access could damage the Cadeler Group’s backlog and future revenue prospects. Brexit could therefore materially adversely affect the Cadeler Group’s business and customers.

If Cadeler’s vessels operate in countries or territories that are subject to restrictions, sanctions, or embargoes imposed by the U.S. government, the European Union, the United Nations, or other governments, it could lead to monetary fines or other penalties and adversely affect Cadeler’s reputation and the market for its shares and trading price.

Although Cadeler does not expect that its vessels will operate in countries or territories subject to country-wide or territory wide sanctions or embargoes imposed by the U.S. government and other authorities in violation of applicable sanctions laws, and Cadeler endeavors to take precautions reasonably designed to mitigate the risk of such activities, it is possible that such vessels may call on ports located, and/or otherwise, operate in countries or territories subject to such sanctions, including on charterers’ instructions and/or without Cadeler’s consent. In addition, certain of Cadeler’s New Builds are being built in China, which depending on the developments in the geopolitics environment in that region, may further expose Cadeler to certain restrictions. Similarly, Cadeler’s supply chain for spare parts for the vessels or secondary steel deliveries needs to be monitored closely and may be limited due to these restrictions, which could result in Cadeler not being able to source such spare parts from certain suppliers.

Failure to comply with the U.S. Foreign Corrupt Practices Act could result in fines, criminal penalties, contract terminations and have an adverse effect on the Cadeler Group’s business.

The Cadeler Group operates in a number of countries throughout the world, including countries known to have a reputation for corruption. The Cadeler Group is committed to doing business in accordance with applicable anti-corruption laws including the U.S. Foreign Corrupt Practices Act of 1977 (“FCPA”), U.K. Bribery Act, the Danish Criminal Code and other applicable anti-corruption laws. The Cadeler Group is subject, however, to the risk that Cadeler, its affiliated entities or its officers, directors, employees and agents may take actions determined to be in violation of such anti-corruption laws, including the FCPA and U.K. Bribery Act. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties and curtailment of operations in certain jurisdictions, and might adversely affect the Cadeler Group’s business, prospects and financial results and condition. In addition, actual or alleged violations could damage Cadeler’s reputation and ability to do business. Furthermore, detecting, investigating, and resolving actual or alleged violations is expensive and has the potential to consume significant time and attention of Cadeler’s senior management.

12

Breakdowns in the Cadeler Group’s information technology and/or noncompliance with data protection laws could negatively impact the Cadeler Group’s business, including its ability to service customers.

The Cadeler Group’s ability to operate its business and service its customers is dependent on the continued operation of the Cadeler Group’s IT systems, including those relating to the location, operation, maintenance and employment of the Cadeler Group’s vessels. The Cadeler Group’s IT systems could be compromised by a malicious third party or employee (see also “—A cybersecurity attack could materially disrupt the Cadeler Group’s business”), man-made or natural events, or the inadvertent actions or inactions by the Cadeler Group’s employees and third-party service providers. If the Cadeler Group’s IT systems experience a breakdown, the Cadeler Group’s business information could be lost, destroyed, disclosed, misappropriated, altered or accessed without consent, and the Cadeler Group’s IT systems, or those of its service providers, may be disrupted.

Any breakdown in the Cadeler Group’s IT systems could lead to lost revenues resulting from a loss in competitive advantage due to the unauthorized disclosure, alteration, destruction or use of proprietary information, the failure to retain or attract customers, the disruption of critical business processes or IT systems and the diversion of management’s attention and resources. In addition, such breakdown could result in significant remediation costs, including repairing system damage, engaging third-party experts, deploying additional personnel, training employees and compensation or incentives offered to third parties whose data has been compromised. The Cadeler Group may also be subject to legal claims or legal proceedings, including regulatory investigations and actions, and the attendant legal fees as well as potential settlements, judgments and fines.

In addition, data protection laws apply to the Cadeler Group in certain countries in which it does business. Specifically, the EU General Data Protection Regulation (“GDPR”) imposes penalties of up to a maximum of 4% of global annual turnover for breaches thereof. The GDPR requires mandatory breach notification, the standard for which is also followed outside the EU (particularly in Asia). Non-compliance with data protection laws could expose the Cadeler Group to regulatory investigations, which could result in fines and penalties. In addition to imposing fines, regulators may issue orders to stop processing personal data, which could disrupt operations. The Cadeler Group could also be subject to litigation from persons or corporations allegedly affected by data protection violations. Any violation of these laws or harm to the Cadeler Group’s reputation could have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition.

A cybersecurity attack could materially disrupt the Cadeler Group’s business.

The efficient operation of the Cadeler Group’s business, including processing, transmitting and storing electronic and financial information, is dependent on computer hardware and software systems. IT systems are vulnerable to security breaches by computer hackers and cyber terrorists. The Cadeler Group relies on industry accepted security measures and technology (including a cloud-based solution provided by Microsoft including their E5 security suite) to securely maintain confidential and proprietary information maintained on its information systems. However, such measures and technology may not adequately prevent security breaches. Therefore, the Cadeler Group’s operations and business administration could be targeted by individuals or groups seeking to sabotage or disrupt such systems and networks, or to steal data, and as a result these systems may be damaged, shut down or cease to function properly (whether due to planned upgrades, force majeure, telecommunications failures, hardware or software break-ins or viruses, other cybersecurity incidents or otherwise), which could have a material adverse effect on the Cadeler Group’s reputation as well as its business, prospects and financial results and condition.

Cybersecurity attacks may result in disruptions to the Cadeler Group’s operations or in business data being temporarily unreadable, and cyber criminals may demand ransoms in exchange for de-encrypting such data. As cybersecurity attacks become increasingly sophisticated, and as tools and resources become more readily available to malicious third parties, there can be no guarantee that the Cadeler Group’s actions, security measures and controls designed to prevent, detect or respond to intrusion, to limit access to data, to prevent destruction or alteration of data or to limit the negative impact from such attacks, can provide absolute security against compromise. Even without actual breaches of information security, protection against increasingly sophisticated and prevalent cybersecurity attacks may result in significant future prevention, detection, response and management costs, or other costs, including the deployment of additional cybersecurity technologies, engaging third-party experts, deploying additional personnel and training employees. Further, as cybersecurity threats are continually evolving, the Cadeler Group’s controls and procedures may become inadequate, and the Cadeler Group may be required to devote additional resources to modify or enhance its systems in the future. Such expenses could have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition.

13

A successful cybersecurity attack could materially disrupt the Cadeler Group’s operations or result in the unauthorized release or alteration of information in the Cadeler Group’s systems, particularly if the Cadeler Group’s IT systems were affected for extended periods. Any cybersecurity attack could also result in significant expenses to investigate and repair security breaches or system damages and could lead to litigation, fines, other remedial action, heightened regulatory scrutiny, diminished customer confidence and damage to the Cadeler Group’s reputation. The Cadeler Group does not currently maintain cyber-liability insurance to cover such losses. As a result, a cybersecurity attack or other breach of any such IT systems could have a material adverse effect on the Cadeler Group’s business, prospects and financial results and condition.

The Cadeler Group is subject to restrictive covenants and conditions pursuant to its financing agreements.

The Cadeler Group has entered and will in the future enter into debt financing agreements, including, but not limited to, the Debt Facility, the Holdco Facility, the P-Class Facility and the New Debt Facility (as defined below). See also Item 5.B. “Liquidity and Capital Resources—Financing Arrangements” of this Annual Report on Form 20-F. Such agreements and arrangements contain many terms, conditions and covenants that may be challenging to comply with, restrict the Cadeler Group’s ability to obtain new debt or other financing and/or restrict the Cadeler Group’s freedom to operate.

For instance, there are specific financial covenants in the Debt Facility with respect to the minimum liquidity of the Cadeler Group, fair market value of the Operating O-Class Vessels and equity ratio of the Cadeler Group. Similar financial covenants are included in the New Debt Facility, which also includes a financial covenant with respect to working capital. Failure to meet any of these covenants could trigger the mandatory repayment of the Debt Facility and may thus have an adverse effect on the financial position of the Cadeler Group. Additionally, the Debt Facility, the Holdco Facility and the P-Class Facility each are subject to certain change of control provisions and contain covenants restricting the payments of dividends.

Since the Cadeler Group currently only has four Operating Vessels in operation, its ability to be compliant with financial covenant requirements pursuant to its financing arrangements will to a great extent depend on the market value of these vessels and their ability to generate revenue until the Cadeler Group’s ordered New Builds are delivered. If future cash flows are insufficient to meet all of the Cadeler Group’s financial obligations and contractual commitments, any such insufficiency could negatively impact the Cadeler Group’s business. To the extent that the Cadeler Group is unable to repay any indebtedness as it becomes due or at maturity, the Cadeler Group may need to refinance its debt, raise new debt, sell assets or repay the debt with proceeds from equity offerings.

The Cadeler Group’s indebtedness could affect the Cadeler Group’s future operations, since a portion of the Cadeler Group’s cash flow from operations will be dedicated to the payment of interest and principal on such indebtedness and will not be available for other purposes. Covenants may or will require the Cadeler Group to meet certain financial tests and non-financial tests, which may affect the Cadeler Group’s flexibility in planning for, and reacting to, changes in its business or economic conditions, and may limit the Cadeler Group’s ability to dispose of assets or place restrictions on the use of proceeds from such dispositions. Such covenants may also limit the Cadeler Group’s ability to withstand current or future economic or industry downturns, to compete with others in the Cadeler Group’s industry for strategic opportunities, or to obtain additional financing for working capital, capital expenditures, acquisitions, general corporate and other purposes. See also “—Risks Related to the Business Combination—As a result of the Business Combination, the Cadeler Group faces financial risk due to its level of indebtedness.”

Litigation proceedings could have a material adverse impact on the business, prospects and financial results and condition of the Cadeler Group.

The nature of the business of the Cadeler Group from time to time results in clients, subcontractors, employees/manning agencies or vendors claiming, among other things, recovery of costs related to accidents, contracts and projects. The crane accident in 2018 on Wind Osprey, for example, resulted in a claim from the charterers of EUR 6.25 million as well as personal injury claims by four seafarers involved in the accident. The outcome of these claims is uncertain. Should any of the Cadeler Group’s vessels experience or be involved in any future incidents of a similar nature, the Cadeler Group may be subject to further claims and litigation. Litigation outcomes are unpredictable and may result in reputational damage as well as fines, penalties or other sanctions imposed by governmental authorities or general damages payable by the Cadeler Group in respect of third-party claims such as for example, personal injury claims, employment related claims or property damage.

14